Question: Please show work. Santini's new contract for 2016 indicates the following compensation and benefits: Santini is 54 years old at the end of 2016. He

Please show work.

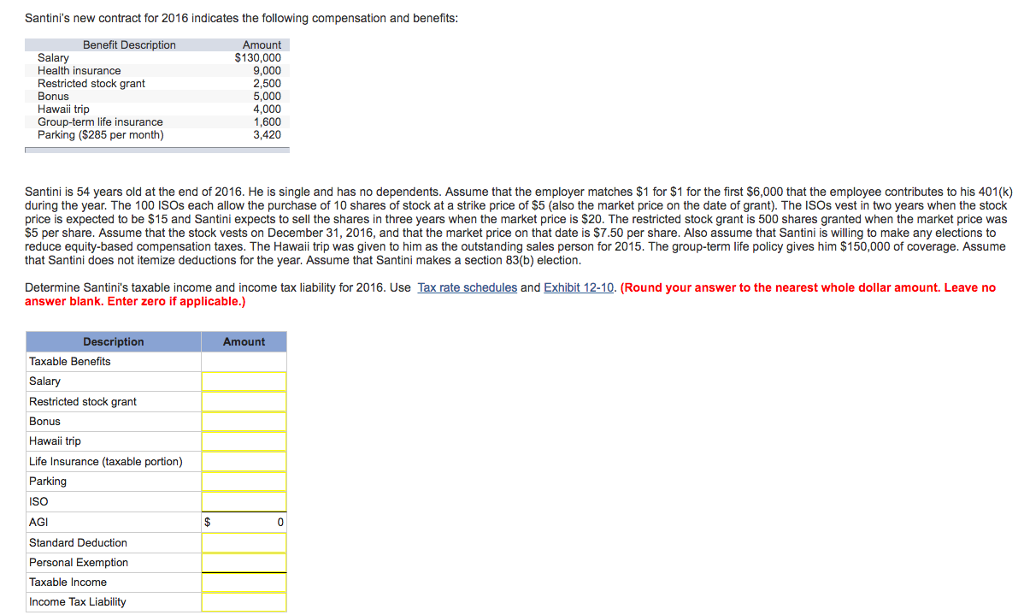

Santini's new contract for 2016 indicates the following compensation and benefits: Santini is 54 years old at the end of 2016. He is single and has no dependents. Assume that the employer matches $1 for $1 for the first $6,000 that the employee contributes to his 401(k) during the year. The 100 ISOs each allow the purchase of 10 shares of stock at a strike price of $5 (also the market price on the date of grant). The ISOs vest in two years when the stock price is expected to be $15 and Santini expects to sell the shares in three years when the market price is $20. The restricted stock grant is 500 shares granted when the market price was $5 per share. Assume that the stock vests on December 31, 2016, and that the market price on that date is $7.50 per share. Also assume that Santini is willing to make any elections to reduce equity-based compensation taxes. The Hawaii trip was given to him as the outstanding sales person for 2015. The group-term life policy gives him $150,000 of coverage. Assume that Santini does not itemize deductions for the year. Assume that Santini makes a section 83(b) election. Determine Santini's taxable income and income tax liability for 2016. Use Tax rate schedules and Exhibit 12-10. (Round your answer to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts