Santinis new contract for 2019 indicates the following compensation and benefits: Santini is 54 years old at

Question:

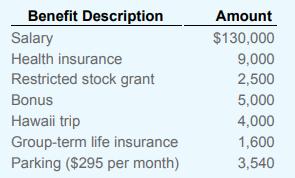

Santini’s new contract for 2019 indicates the following compensation and benefits:

Santini is 54 years old at the end of 2019. He is single and has no dependents. Assume that the employer matches $1 for $1 for the first $6,000 that the employee contributes to his 401(k) during the year. The restricted stock grant is 500 shares granted when the market price was $5 per share. Assume that the stock vests on December 31, 2019, and that the market price on that date is $7.50 per share. Also assume that Santini is willing to make any elections to reduce equity-based compensation taxes. The Hawaii trip was given to him as the outstanding salesperson for 2018. The group-term life policy gives him $150,000 of coverage. Assume that Santini does not itemize deductions for the year. Determine Santini’s taxable income and income tax liability for 2019.

Step by Step Answer:

McGraw Hills Essentials Of Federal Taxation 2020 Edition

ISBN: 9781260433128

11th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver