Question: Please show work step by step. I know for sure the answer is not 59375 which I got to when I used 6500 for IRA

Please show work step by step. I know for sure the answer is not 59375 which I got to when I used 6500 for IRA deduction. Thank you

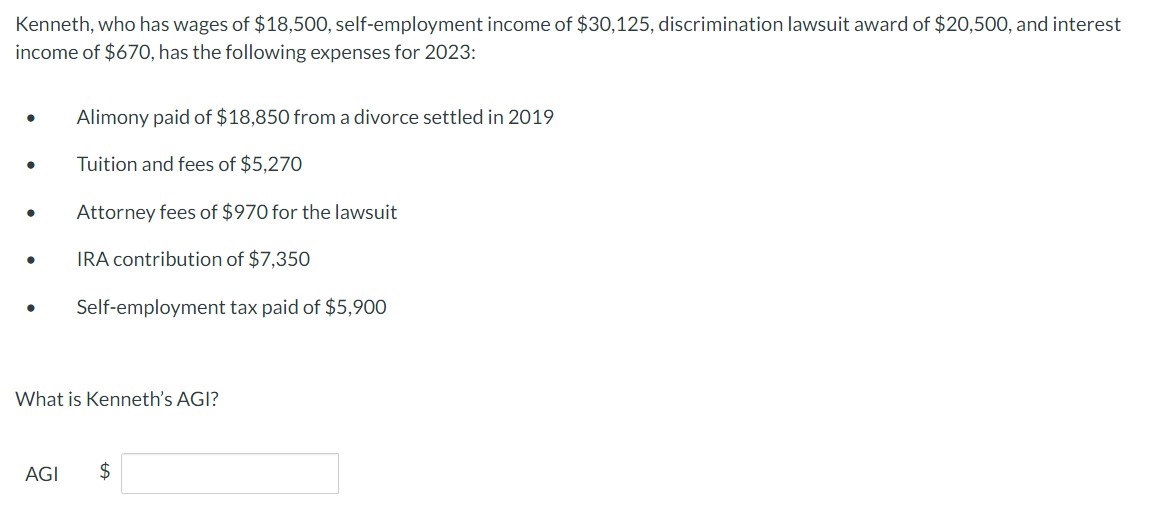

Kenneth, who has wages of $18,500, self-employment income of $30,125, discrimination lawsuit award of $20,500, and interest income of $670, has the following expenses for 2023: Alimony paid of $18,850 from a divorce settled in 2019 Tuition and fees of $5,270 Attorney fees of $970 for the lawsuit IRA contribution of $7,350 Self-employment tax paid of $5,900 What is Kenneth's AGI? AGI $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts