Question: Please show work. Step-by-step on how answer was calculated ou are bullish on Telecom stock. The current market pricc is $50 per share, and you

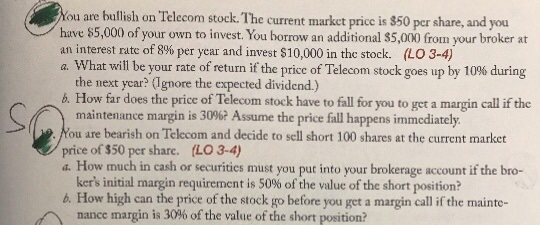

ou are bullish on Telecom stock. The current market pricc is $50 per share, and you have $5,000 of your own to invest. You borrow an additional $5,000 from your broker at an interest rate of 8% per year and invest $10,000 in the stock. (LO 3-4) a. What will be your rate of return if the pricc of Telecom stock goes up by 10% during the next ycar? (Ignore the expected dividend.) b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 3096? Assume the price fall happens immediately ou are bearish on Telecom and decide to sell short 100 shares at the current markot price of $50 per share. (LO 3-4) a. How much in cash or securities must you put into your brokerage account if the bro- kers initial margin requirement is 50% of the value of the short position? b. How high can the price of the stock go before you get a margin call if the mainte- nance margin is 30% of the value of the short position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts