Question: please show work - Thank you Given a portfolio composed of only two assets (Asset A and Asset B), and with the following knowledge: 1.

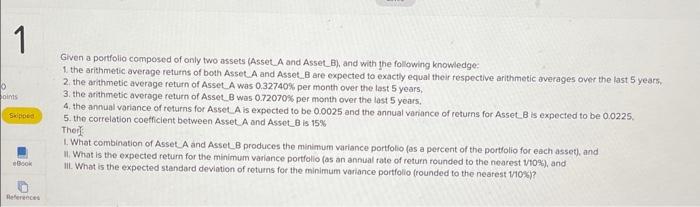

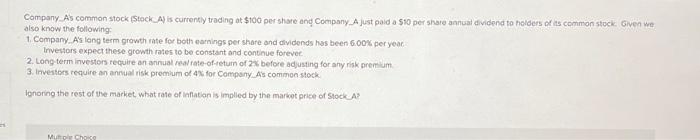

Given a portfolio composed of only two assets (Asset A and Asset B), and with the following knowledge: 1. the arithmetic average returns of both Asset. A and Asset. B are expected to exactly equal their fespective arithmetic averages over the last 5 years. 2. the arthmetic average return of Asset A was 0.32740% per month over the lest 5 years, 3. the arithmetic average return of Asset B was 0.72070% per month over the last 5 years. 4. the annual variance of returns for Asset A is expected to be 0.0025 and the annual variance of returns for Asset B is expected to be 0.0225 . 5. the correlation coefficlent botween Asset A and Asset B is 15% Ther: 1. What combination of Asset_A and Asset.B produces the minimum variance portfolio (as a percent of the portfolio for each asset), and III. What is the expected standard deviation of returns for the minimum variance portfolio (rounded to the nearest 1/10% )? Company As common stock (Stock A) is currently trading at \$100 per share and Company_A just paid a $10 per share aanual dividend to helders of as common stock. Given we. also know the following: 1. Company. A's long term growth rate for both earnings per share and dividends has been 6.00k per year Investors expect these growth rates to be constant and continue forever. 2. Long-term investors require an annual real rate-of-tetum of 2 before adjusting for any risk onemium. 3. investors require an annual risk premum of 4x for Compsny. As common stock. lgnoring the rest of the market what rate of inflatian is implied by the markot price of Stock As Given a portfolio composed of only two assets (Asset A and Asset B), and with the following knowledge: 1. the arithmetic average returns of both Asset. A and Asset. B are expected to exactly equal their fespective arithmetic averages over the last 5 years. 2. the arthmetic average return of Asset A was 0.32740% per month over the lest 5 years, 3. the arithmetic average return of Asset B was 0.72070% per month over the last 5 years. 4. the annual variance of returns for Asset A is expected to be 0.0025 and the annual variance of returns for Asset B is expected to be 0.0225 . 5. the correlation coefficlent botween Asset A and Asset B is 15% Ther: 1. What combination of Asset_A and Asset.B produces the minimum variance portfolio (as a percent of the portfolio for each asset), and III. What is the expected standard deviation of returns for the minimum variance portfolio (rounded to the nearest 1/10% )? Company As common stock (Stock A) is currently trading at \$100 per share and Company_A just paid a $10 per share aanual dividend to helders of as common stock. Given we. also know the following: 1. Company. A's long term growth rate for both earnings per share and dividends has been 6.00k per year Investors expect these growth rates to be constant and continue forever. 2. Long-term investors require an annual real rate-of-tetum of 2 before adjusting for any risk onemium. 3. investors require an annual risk premum of 4x for Compsny. As common stock. lgnoring the rest of the market what rate of inflatian is implied by the markot price of Stock As

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts