Question: please show work thank you If you bought a security for 270.59 and 9 months later you sold it for 5 245.77 , what is

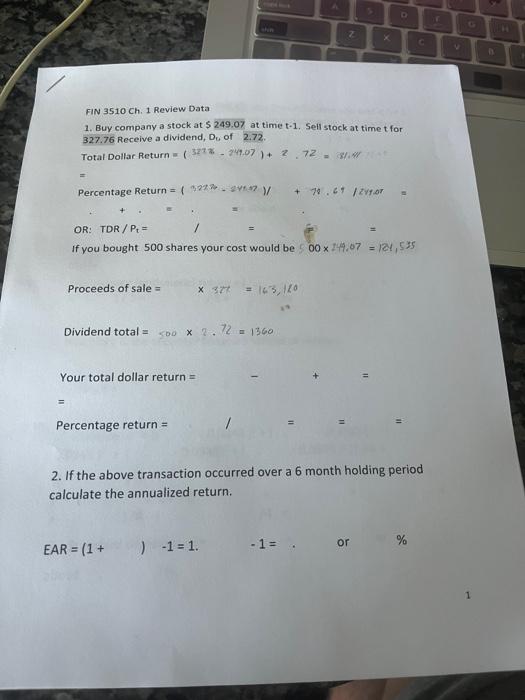

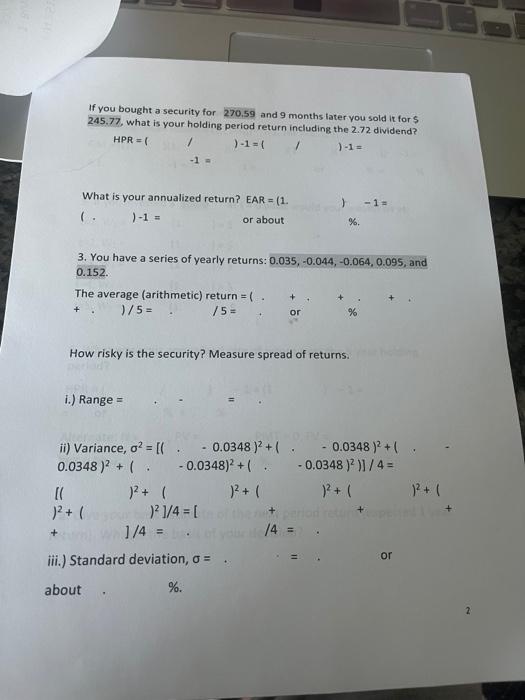

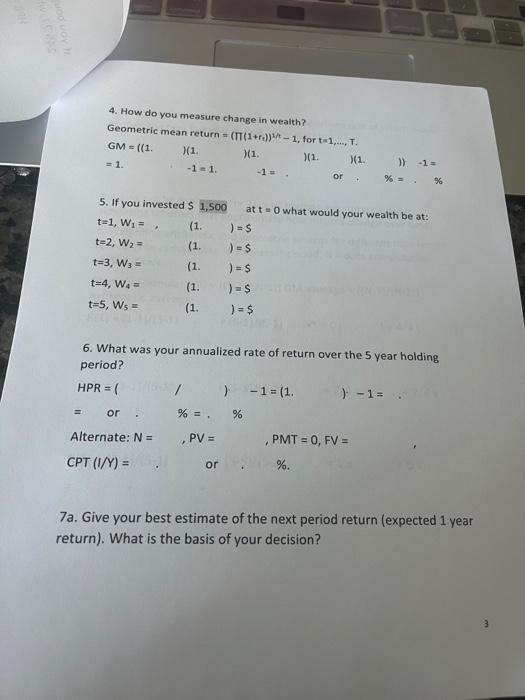

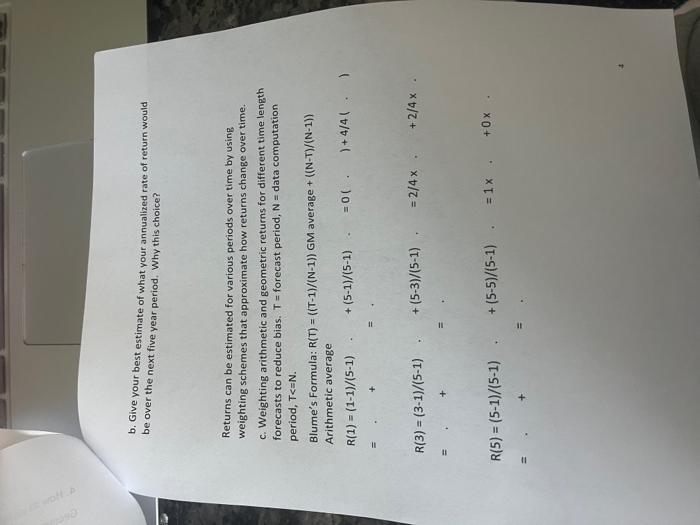

If you bought a security for 270.59 and 9 months later you sold it for 5 245.77 , what is your holding period return including the 2.72 dividend? HPR=1 1=1=1,)1= What is your annualized return? EAR =(1. 1 . 1= or about ) 1= %. 3. You have a series of yearly returns: 0.035,0.044,0.064,0.095, and 0.152 . The average (arithmetic) return =1. How risky is the security? Measure spread of returns. i.) Range = ii)Variance,2=[(.0.0348)2+(0.0348)2+(.0.0348)2+(0.0348)2+(0.0348)2)]/4=)2+()2+()2+()2++()2]/4=[++1/4=14= Standard deviation, = 4. How do you measure change in wealth? Geometricmeanreturn=((1+rt))1/t1,fort=1,,T.GM=((1.=1.x)(1.1=1.)(1.1= ) 1. or i) 1= %=.% 5. If you invested $1,500 at t=0 what would your wealth be at: t=1,W1=t=2,W2=t=3,W3=t=4,W4=t=5,W5= (1. )=$ (1. )=$ (1. )=$ (1. )=$ (1. )=$ 6. What was your annualized rate of return over the 5 year holding period? HPR=()1=(1.).1==or.%=%Alternate:N=,PV=,PMT=0,FV=CPT(I/Y)=or%. 7a. Give your best estimate of the next period return (expected 1 year return). What is the basis of your decision? Total Dollar Return =(327%249.07)+2.72=8%.4% = OR: TDR/Pt= == If you bought 500 shares your cost would be 500249.07=124,55 Proceeds of sale =376=163,120 Dividend total =5002.72=1360 Your total dollar return = = Percentage return = 2. If the above transaction occurred over a 6 month holding period calculate the annualized return. EAR=(1+)1=1.1=or% b. Give your best estimate of what your annualized rate of return would be over the next five year period. Why this choice? Returns can be estimated for various periods over time by using weighting schemes that approximate how returns change over time. c. Weighting arithmetic and geometric returns for different time length forecasts to reduce bias. T= forecast period, N= data computation period, T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts