Question: Please show work :) thanks! 2. (Using matrix method to solve efficient portfolio) Suppose there exists three assets, their expected returns R1,R2,R3 are 5%,6%,8%. The

Please show work :) thanks!

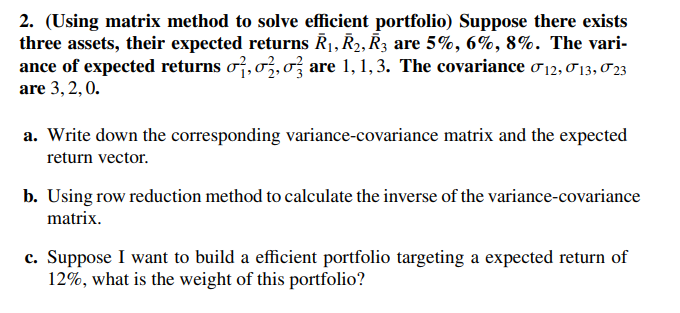

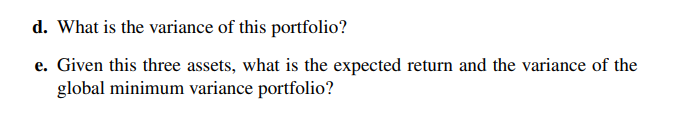

2. (Using matrix method to solve efficient portfolio) Suppose there exists three assets, their expected returns R1,R2,R3 are 5%,6%,8%. The variance of expected returns 12,22,32 are 1,1,3. The covariance 12,13,23 are 3,2,0. a. Write down the corresponding variance-covariance matrix and the expected return vector. b. Using row reduction method to calculate the inverse of the variance-covariance matrix. c. Suppose I want to build a efficient portfolio targeting a expected return of 12%, what is the weight of this portfolio? d. What is the variance of this portfolio? e. Given this three assets, what is the expected return and the variance of the global minimum variance portfolio? 2. (Using matrix method to solve efficient portfolio) Suppose there exists three assets, their expected returns R1,R2,R3 are 5%,6%,8%. The variance of expected returns 12,22,32 are 1,1,3. The covariance 12,13,23 are 3,2,0. a. Write down the corresponding variance-covariance matrix and the expected return vector. b. Using row reduction method to calculate the inverse of the variance-covariance matrix. c. Suppose I want to build a efficient portfolio targeting a expected return of 12%, what is the weight of this portfolio? d. What is the variance of this portfolio? e. Given this three assets, what is the expected return and the variance of the global minimum variance portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts