Question: Please show work Use an Excel function to calculate the modified duration of Bond A and Bond B from the previous question. Note: When using

Please show work

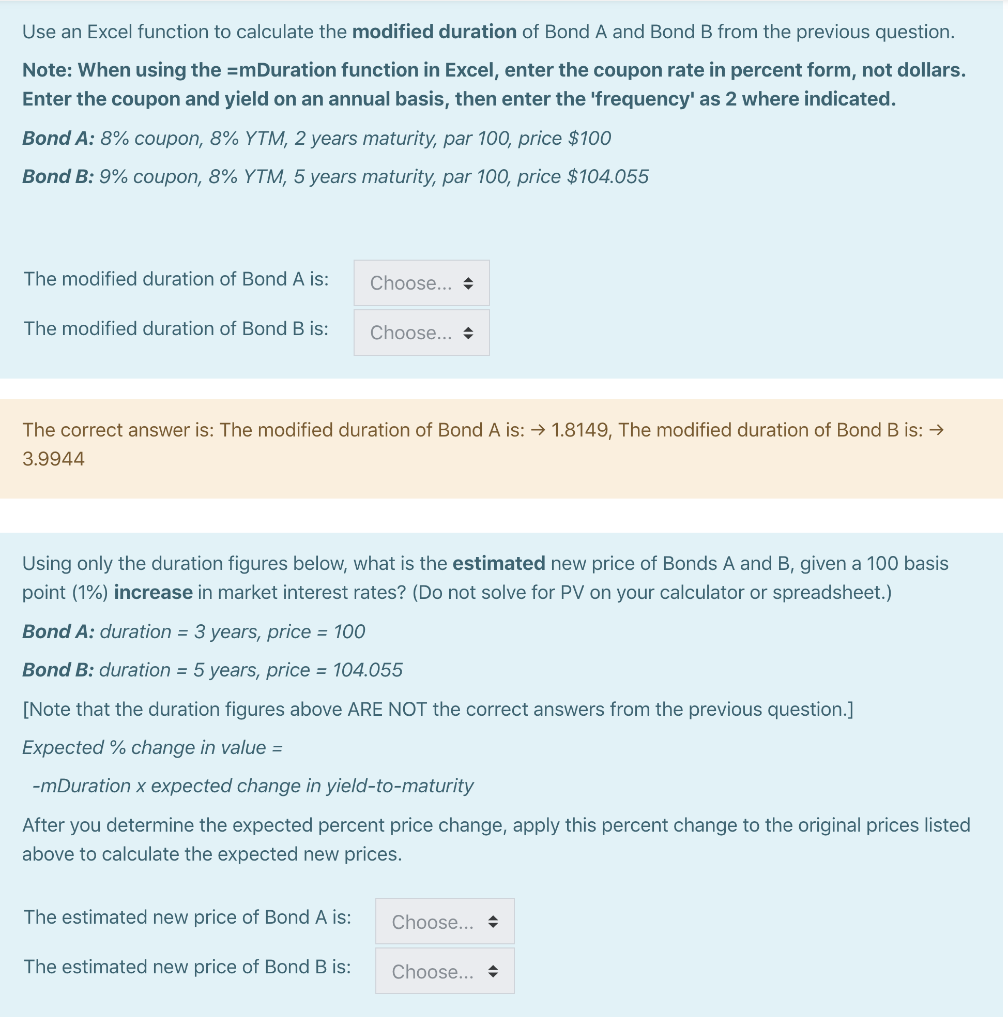

Use an Excel function to calculate the modified duration of Bond A and Bond B from the previous question. Note: When using the =mDuration function in Excel, enter the coupon rate in percent form, not dollars. Enter the coupon and yield on an annual basis, then enter the 'frequency' as 2 where indicated. Bond A: 8% coupon, 8% YTM, 2 years maturity, par 100, price $100 Bond B: 9% coupon, 8% YTM, 5 years maturity, par 100, price $104.055 The modified duration of Bond A is: Choose... The modified duration of Bond B is: Choose... - The correct answer is: The modified duration of Bond A is: + 1.8149, The modified duration of Bond B is: 3.9944 Using only the duration figures below, what is the estimated new price of Bonds A and B, given a 100 basis point (1%) increase in market interest rates? (Do not solve for PV on your calculator or spreadsheet.) Bond A: duration = 3 years, price = 100 Bond B: duration = 5 years, price = 104.055 [Note that the duration figures above ARE NOT the correct answers from the previous question.] Expected % change in value = -mDuration x expected change in yield-to-maturity After you determine the expected percent price change, apply this percent change to the original prices listed above to calculate the expected new prices. The estimated new price of Bond A is: Choose... - The estimated new price of Bond B is: Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts