Question: Please show work!!! Use the table for the questions below. Consider the foll 6) What is the difference in cash ratios for PharmPic and DosageDoc

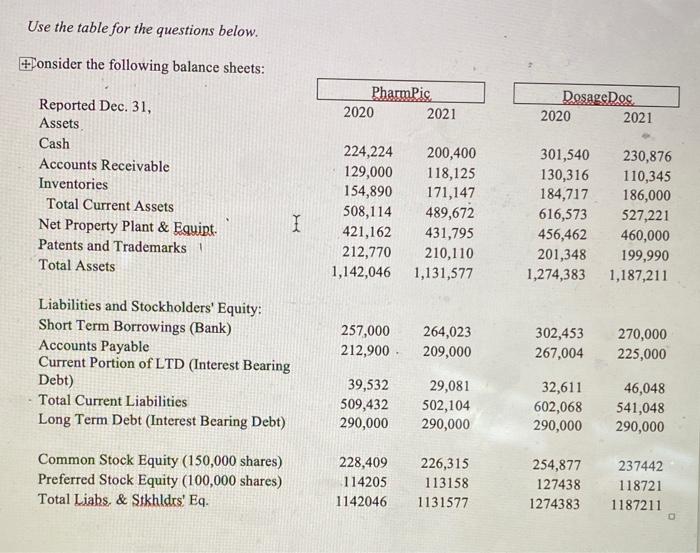

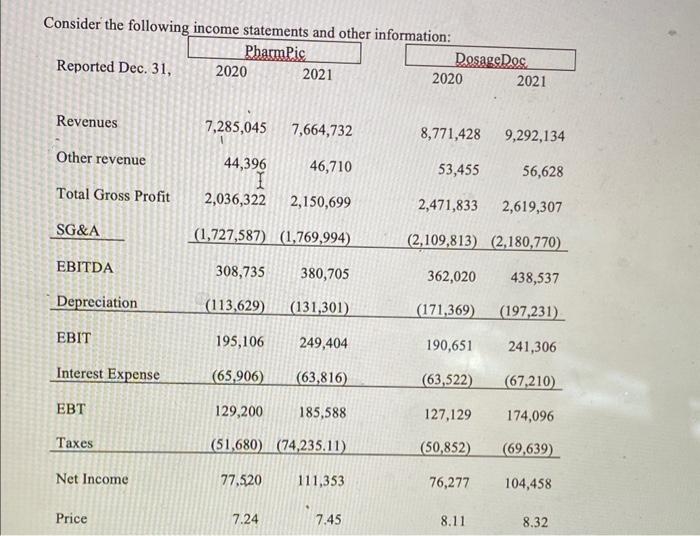

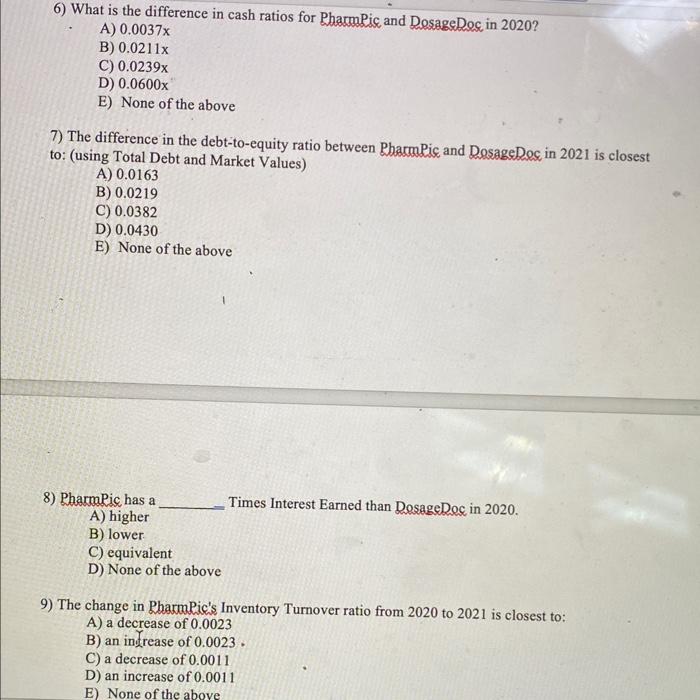

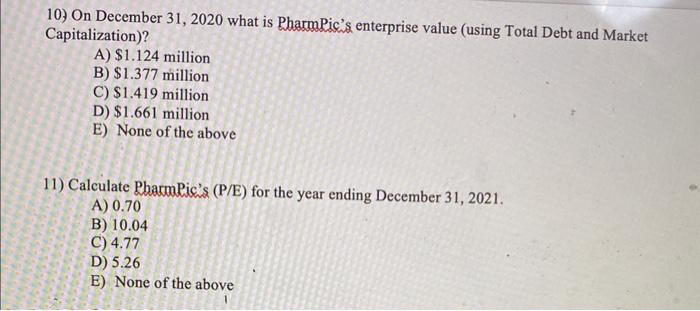

Use the table for the questions below. Consider the foll 6) What is the difference in cash ratios for PharmPic and DosageDoc in 2020 ? A) 0.0037x B) 0.0211x C) 0.0239x D) 0.0600x E) None of the above 7) The difference in the debt-to-equity ratio between PbarmPic and DosageDoc in 2021 is closest to: (using Total Debt and Market Values) A) 0.0163 B) 0.0219 C) 0.0382 D) 0.0430 E) None of the above 8) PharmPic has a A) higher B) lower C) equivalent D) None of the above 9) The change in Pharmpic's Inventory Turnover ratio from 2020 to 2021 is closest to: A) a decrease of 0.0023 B) an indrease of 0.0023. C) a decrease of 0.0011 D) an increase of 0.0011 E) None of the above 6) What is the difference in cash ratios for PharmPic and DosageDoc in 2020 ? A) 0.0037x B) 0.0211x C) 0.0239x D) 0.0600x E) None of the above 7) The difference in the debt-to-equity ratio between PbarmPic and DosageDoc in 2021 is closest to: (using Total Debt and Market Values) A) 0.0163 B) 0.0219 C) 0.0382 D) 0.0430 E) None of the above 8) PharmPic has a A) higher B) lower C) equivalent D) None of the above 9) The change in Pharmpic's Inventory Turnover ratio from 2020 to 2021 is closest to: A) a decrease of 0.0023 B) an indrease of 0.0023. C) a decrease of 0.0011 D) an increase of 0.0011 E) None of the above 10) On December 31,2020 what is PharmPic's enterprise value (using Total Debt and Market Capitalization)? A) $1.124 million B) $1.377 million C) $1.419 million D) $1.661 million E) None of the above 11) Calculate PharmPic's (P/E) for the year ending December 31, 2021. A) 0.70 B) 10.04 C) 4.77 D) 5.26 E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts