Question: Please show work using excel functions such as PMT, PV, FV, NPV, etc... Jean decides that he wants to provide his family with enough life

Please show work using excel functions such as PMT, PV, FV, NPV, etc...

Please show work using excel functions such as PMT, PV, FV, NPV, etc...

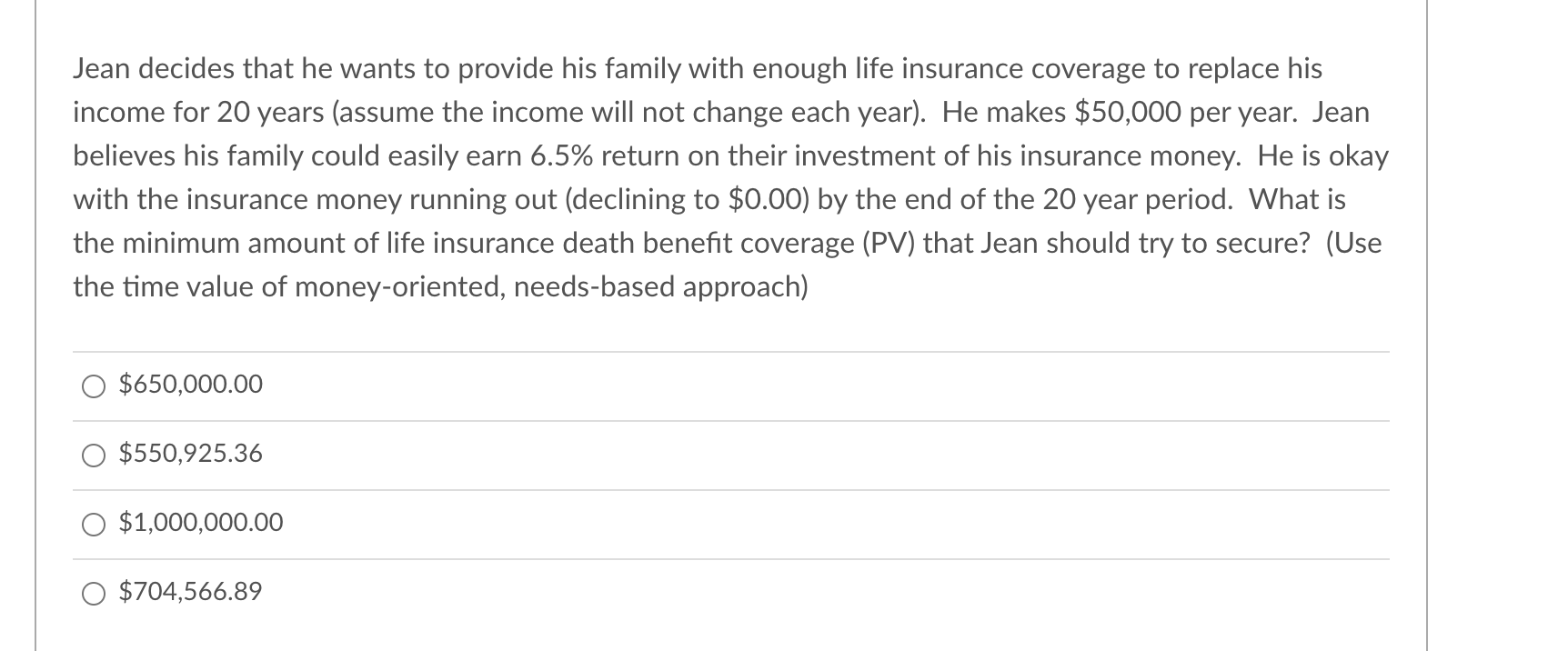

Jean decides that he wants to provide his family with enough life insurance coverage to replace his income for 20 years (assume the income will not change each year). He makes $50,000 per year. Jean believes his family could easily earn 6.5% return on their investment of his insurance money. He is okay with the insurance money running out (declining to $0.00) by the end of the 20 year period. What is the minimum amount of life insurance death benefit coverage (PV) that Jean should try to secure? (Use the time value of money-oriented, needs-based approach) $650,000.00 $550,925.36 $1,000,000.00 $704,566.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts