Question: Please show work using financial formula, thanks. 5. You have recently been looking over 3 stocks to consider purchasing that might be good values and

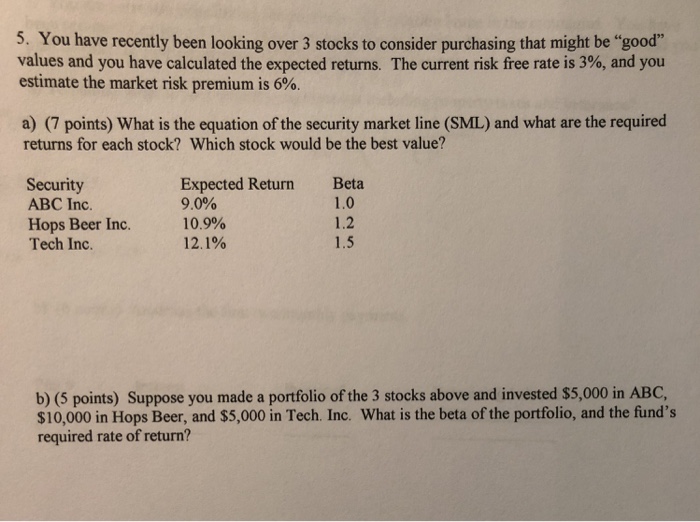

5. You have recently been looking over 3 stocks to consider purchasing that might be "good" values and you have calculated the expected returns. The current risk free rate is 3%, and you estimate the market risk premium is 6%. a) (7 points) What is the equation of the security market line (SML) and what are the required returns for each stok? Which stock would be the best value? Security ABC Inc. Hops Beer Inc. Tech Inc. Beta 1.0 1.2 1.5 Expected Return 9.0% 10.9% 12.1% b) (5 points) Suppose you made a portfolio of the 3 stocks above and invested $5,000 in ABC, $10,000 in Hops Beer, and $5,000 in Tech. Inc. What is the beta of the portfolio, and the fund's required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts