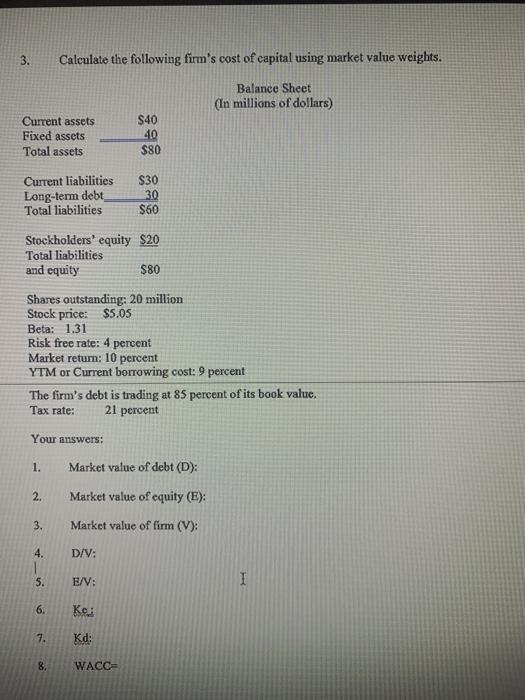

Question: please show work. will drop a like. 3. Calculate the following firm's cost of capital using market value weights. Balance Sheet (In millions of dollars)

3. Calculate the following firm's cost of capital using market value weights. Balance Sheet (In millions of dollars) Current assets Fixed assets Total assets $40 40 $80 Current liabilities Long-term debt Total liabilities $30 30 $60 Stockholders' equity $20 Total liabilities and equity $80 Shares outstanding: 20 million Stock price: $5.05 Beta: 1.31 Risk free rate: 4 percent Market return: 10 percent YTM or Current borrowing cost: 9 percent The firm's debt is trading at 85 percent of its book value. Tax rate: 21 percent Your answers: 1. Market value of debt (D): 2. Market value of equity (E): 3. Market value of firm (V): 4. D/V: S. E/V: I 6. Ke: 7. Kd: 8. WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts