Question: Please show work without excel and include formula. . (10 points) o Using annual compounding, find the duration of a 10-year 8% coupon bond that

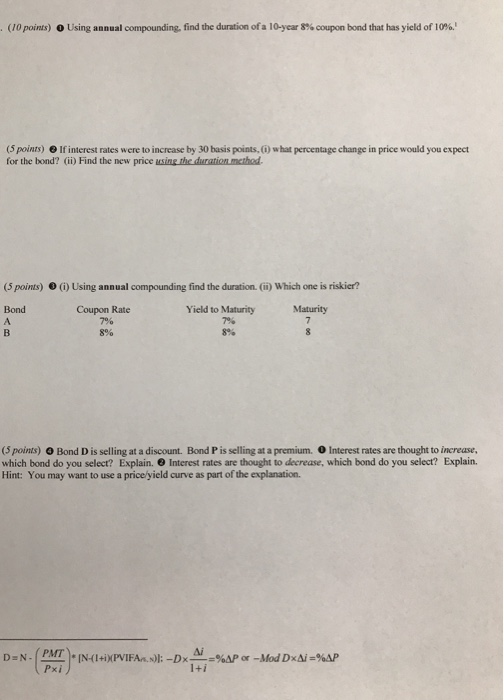

. (10 points) o Using annual compounding, find the duration of a 10-year 8% coupon bond that has yield of 10%. (5 points) If interest rates were to increase by 30 basis points, what percentage change in price would you expect for the bond? (ii) Find the new price using the duration method (5 points) (i) Using annual compounding find the duration. (ii) Which one is riskier? Maturity Bond A B Coupon Rate 796 8% Yield to Maturity 7% 8% 8 (5 points) O Bond Dis selling at a discount. Bond P is selling at a premium. Interest rates are thought to increase, which bond do you select? Explain. Interest rates are thought to decrease, which bond do you select? Explain. Hint: You may want to use a price yield curve as part of the explanation. DEN. PMT Pxi IN-(1+iXPVIFA..:)]:-D Ai =%AP or - Mod DxAi=%AP 1+1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts