Question: **PLEASE SHOW WORKING NOTES WITH CALCULATIONS for A, B, C, D, & E -- so I may compare mine notes. Thank you! 2. An all-equity

**PLEASE SHOW WORKING NOTES WITH CALCULATIONS for A, B, C, D, & E -- so I may compare mine notes. Thank you!

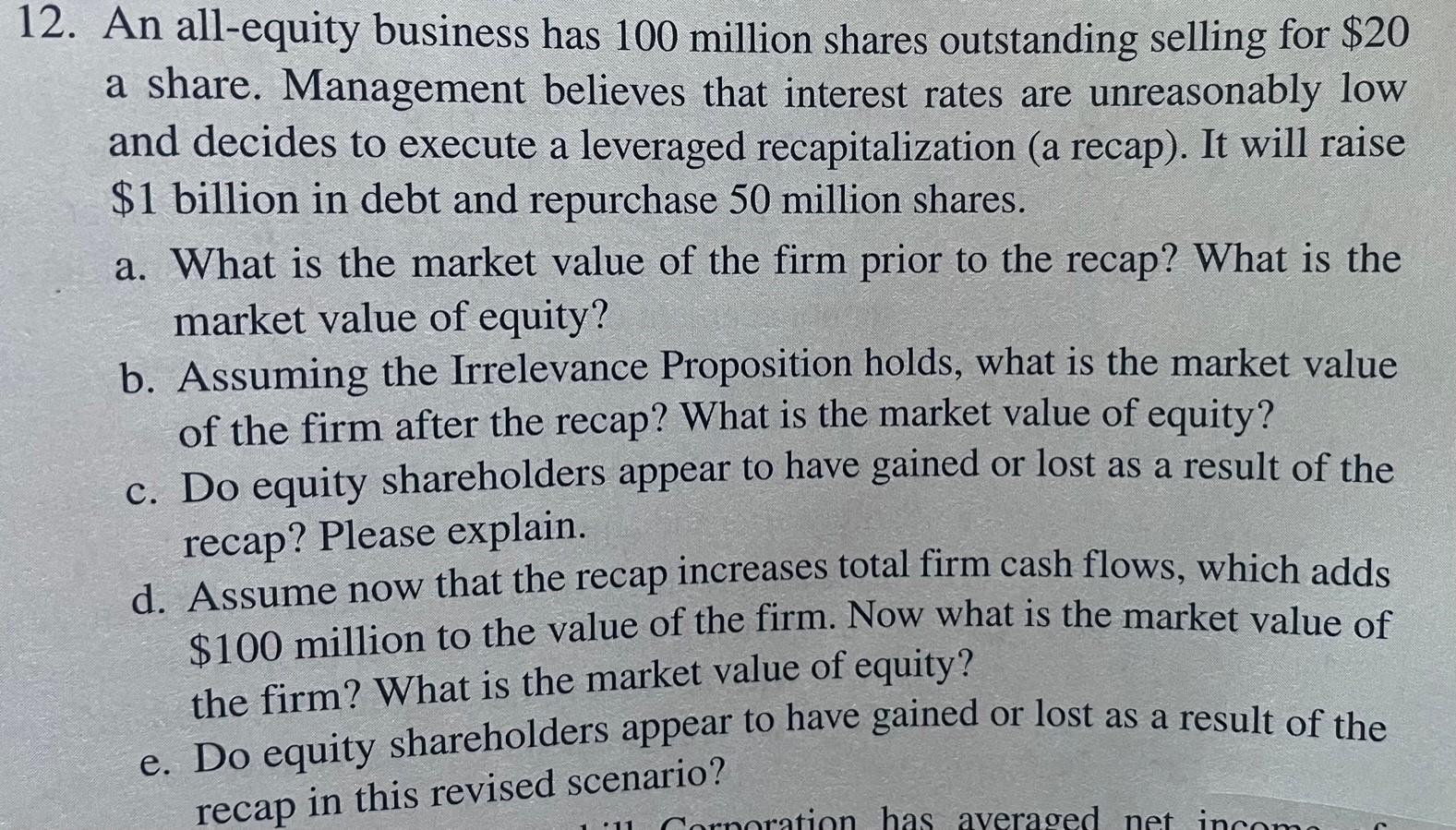

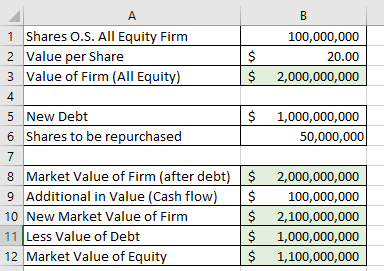

2. An all-equity business has 100 million shares outstanding selling for $20 a share. Management believes that interest rates are unreasonably low and decides to execute a leveraged recapitalization (a recap). It will raise $1 billion in debt and repurchase 50 million shares. a. What is the market value of the firm prior to the recap? What is the market value of equity? b. Assuming the Irrelevance Proposition holds, what is the market value of the firm after the recap? What is the market value of equity? c. Do equity shareholders appear to have gained or lost as a result of the recap? Please explain. d. Assume now that the recap increases total firm cash flows, which adds $100 million to the value of the firm. Now what is the market value of the firm? What is the market value of equity? e. Do equity shareholders appear to have gained or lost as a result of the recap in this revised scenario? \begin{tabular}{|l|l|lr|} \hline & \multicolumn{1}{c|}{ A } & \multicolumn{2}{c|}{ B } \\ \hline 1 & Shares O.S. All Equity Firm & 100,000,000 \\ \hline 2 & Value per Share & $ & 20.00 \\ \hline 3 & Value of Firm (All Equity) & $ & 2,000,000,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline 5 & New Debt & $1,000,000,000 \\ \hline 6 & Shares to be repurchased & 50,000,000 \\ \hline \end{tabular} 7 \begin{tabular}{|c|l|cr|} 8 & Market Value of Firm (after debt) & $ & 2,000,000,000 \\ \hline 9 & Additional in Value (Cash flow) & $ & 100,000,000 \\ \hline 10 & New Market Value of Firm & $ & 2,100,000,000 \\ \hline 11 & Less Value of Debt & $ & 1,000,000,000 \\ \hline 12 & Market Value of Equity & $ & 1,100,000,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts