Question: please show working Question 3 a) The spot rate between Euro and dollar is $0.57 and the observed 1-year forward rate is $0.5556/. The interest

please show working

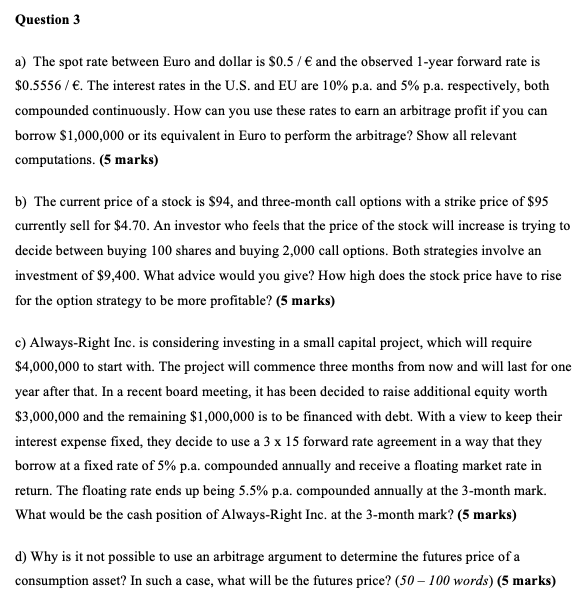

Question 3 a) The spot rate between Euro and dollar is $0.57 and the observed 1-year forward rate is $0.5556/. The interest rates in the U.S. and EU are 10% p.a. and 5% p.a. respectively, both compounded continuously. How can you use these rates to earn an arbitrage profit if you can borrow $1,000,000 or its equivalent in Euro to perform the arbitrage? Show all relevant computations. (5 marks) b) The current price of a stock is $94, and three-month call options with a strike price of $95 currently sell for $4.70. An investor who feels that the price of the stock will increase is trying to decide between buying 100 shares and buying 2,000 call options. Both strategies involve an investment of $9,400. What advice would you give? How high does the stock price have to rise for the option strategy to be more profitable? (5 marks) c) Always-Right Inc. is considering investing in a small capital project, which will require $4,000,000 to start with. The project will commence three months from now and will last for one year after that. In a recent board meeting, it has been decided to raise additional equity worth $3,000,000 and the remaining $1,000,000 is to be financed with debt. With a view to keep their interest expense fixed, they decide to use a 3 x 15 forward rate agreement in a way that they borrow at a fixed rate of 5% p.a. compounded annually and receive a floating market rate in return. The floating rate ends up being 5.5% p.a. compounded annually at the 3-month mark. What would be the cash position of Always-Right Inc. at the 3-month mark? (5 marks) d) Why is it not possible to use an arbitrage argument to determine the futures price of a consumption asset? In such a case, what will be the futures price? (50-100 words) (5 marks) Question 3 a) The spot rate between Euro and dollar is $0.57 and the observed 1-year forward rate is $0.5556/. The interest rates in the U.S. and EU are 10% p.a. and 5% p.a. respectively, both compounded continuously. How can you use these rates to earn an arbitrage profit if you can borrow $1,000,000 or its equivalent in Euro to perform the arbitrage? Show all relevant computations. (5 marks) b) The current price of a stock is $94, and three-month call options with a strike price of $95 currently sell for $4.70. An investor who feels that the price of the stock will increase is trying to decide between buying 100 shares and buying 2,000 call options. Both strategies involve an investment of $9,400. What advice would you give? How high does the stock price have to rise for the option strategy to be more profitable? (5 marks) c) Always-Right Inc. is considering investing in a small capital project, which will require $4,000,000 to start with. The project will commence three months from now and will last for one year after that. In a recent board meeting, it has been decided to raise additional equity worth $3,000,000 and the remaining $1,000,000 is to be financed with debt. With a view to keep their interest expense fixed, they decide to use a 3 x 15 forward rate agreement in a way that they borrow at a fixed rate of 5% p.a. compounded annually and receive a floating market rate in return. The floating rate ends up being 5.5% p.a. compounded annually at the 3-month mark. What would be the cash position of Always-Right Inc. at the 3-month mark? (5 marks) d) Why is it not possible to use an arbitrage argument to determine the futures price of a consumption asset? In such a case, what will be the futures price? (50-100 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts