Question: Please show workings and answer in 3 decimal places. Given the following information, please address the following question. Expected Sharpe return Std. Dev ratio Stock

Please show workings and answer in 3 decimal places.

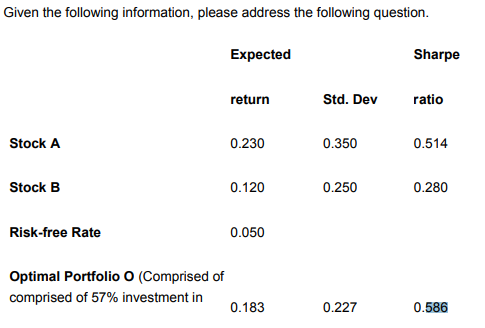

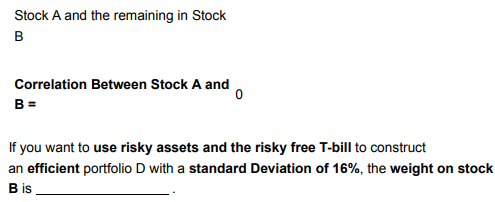

Given the following information, please address the following question. Expected Sharpe return Std. Dev ratio Stock A 0.230 0.350 0.514 Stock B 0.120 0.250 0.280 Risk-free Rate 0.050 Optimal Portfolio O (Comprised of comprised of 57% investment in 0 183 0.227 0.586 Stock A and the remaining in Stock Correlation Between Stock A and B = If you want to use risky assets and the risky free T-bill to construct an efficient portfolio D with a standard Deviation of 16%, the weight on stock B is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts