Question: please show workings for the objectives Instructions: For the objectives show workings. Deadline. 10 April, 2021 1) Astock just paid a dividend of D-$1.50. The

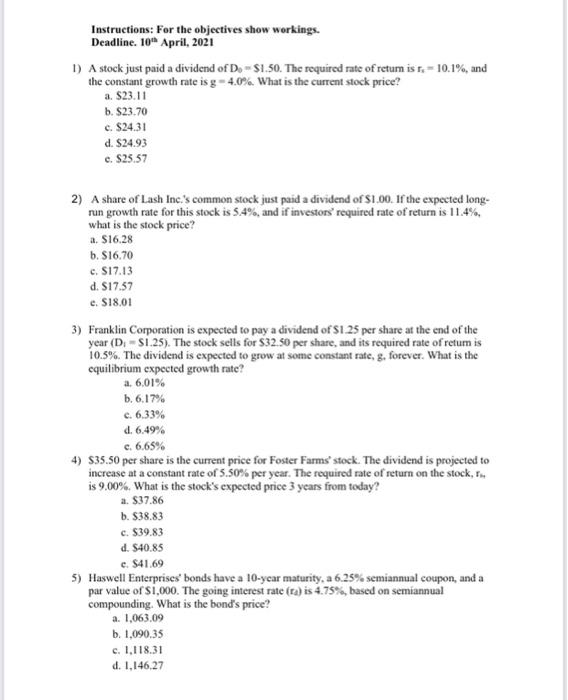

Instructions: For the objectives show workings. Deadline. 10 April, 2021 1) Astock just paid a dividend of D-$1.50. The required rate of retum is t.- 10.1%, and the constant growth rate is g -4.0%. What is the current stock price? a. $23.11 b. $23.70 c. $24.31 d. $24.93 c. $25.57 2) A share of Lash Inc.'s common stock just paid a dividend of $1.00. If the expected long- run growth rate for this stock is 5.4%, and if investors' required rate of return is 11.4% what is the stock price? a. $16.28 b. $16.70 c. $17.13 d. 817.57 e. $18.01 3) Franklin Corporation is expected to pay a dividend of 1.25 per share at the end of the year (D. - $1.25). The stock sells for $32.50 per share, and its required rate of retum is 10.5%. The dividend is expected to grow at some constant rate, g, forever. What is the equilibrium expected growth rate? a. 6,01% b.6.17% c. 6.33% d. 6.49% c. 6,65% 4) $35.50 per share is the current price for Foster Farms stock. The dividend is projected to increase at a constant rate of 5.50% per year. The required rate of return on the stock, is 9.00% What is the stock's expected price 3 years from today? a $37.86 b. $38.83 c. $39.83 d. 840.85 e. $41.69 5) Haswell Enterprises' bonds have a 10-ycar maturity, a 6.25% semiannual coupon, and a par value of 1,000. The going interest rate (ta) is 4.75%, based on semiannual compounding. What is the bond's price? a. 1,063,09 b. 1,090.35 c. 1.118.31 d. 1.146.27 e. 1,174.93 6) Rogoff Co.'s 15-year bonds have an annual coupon rate of 9.5%. Each bond has face value of $1,000 and makes semiannual interest payments. If you require an 11.0% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond? a. $891.00 b. 8913.27 c. $936.10 d. $959.51 e. $983.49 7) Kessen Inc.'s bonds mature in 7 years, have a par value of $1,000, and make an annual coupon payment of $70. The market interest rate for the bonds is 8.5%. What is the bond's price? a. $923.22 b. $946.30 c. $969.96 d. $994.21 e. $1,019.06 8) Discuss 4 approaches a firm can obtain equity capital from the capital market. 9) Using the loanable fund theory, examine the crowd out effect of government borrowings due to deficit on own private sector access to funds and its impact on interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts