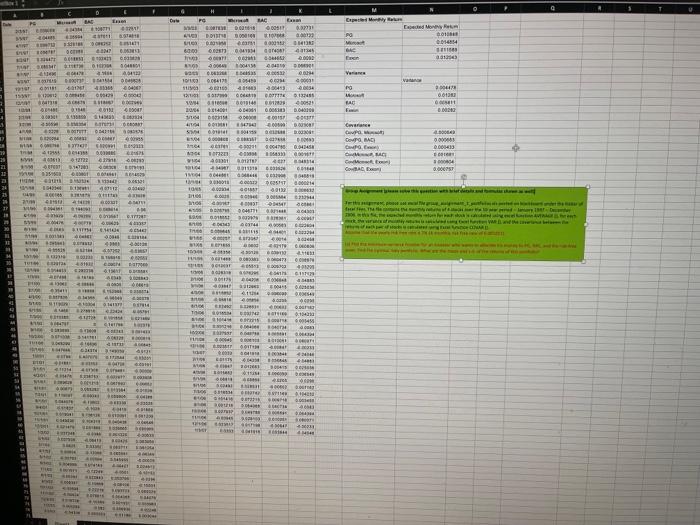

Question: please show work/steps - CHE TE ST NE H Wet SE WIR THE AROLE CHE w CE CE TH TEL HP IH 400 . 2009

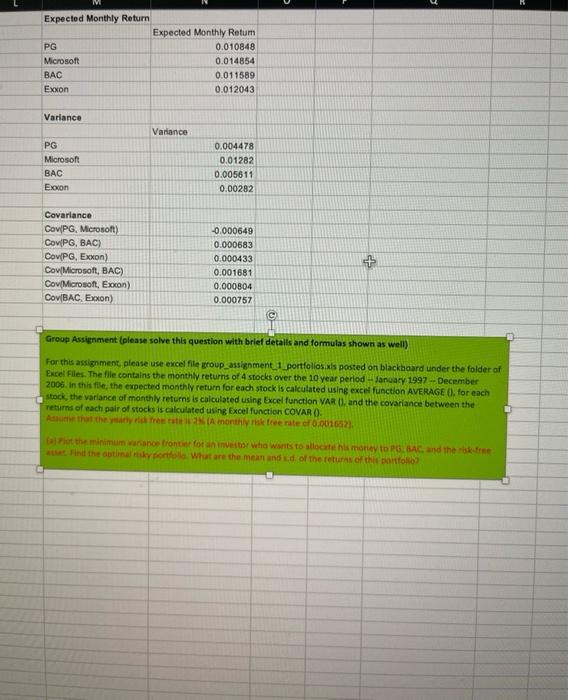

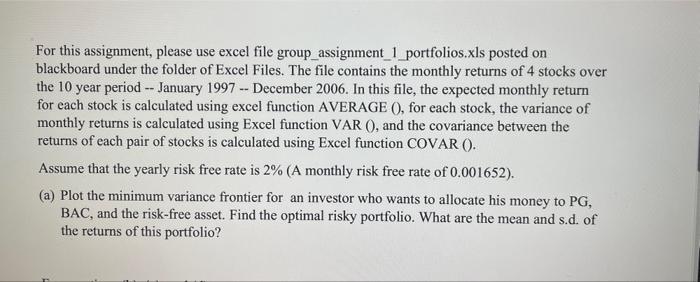

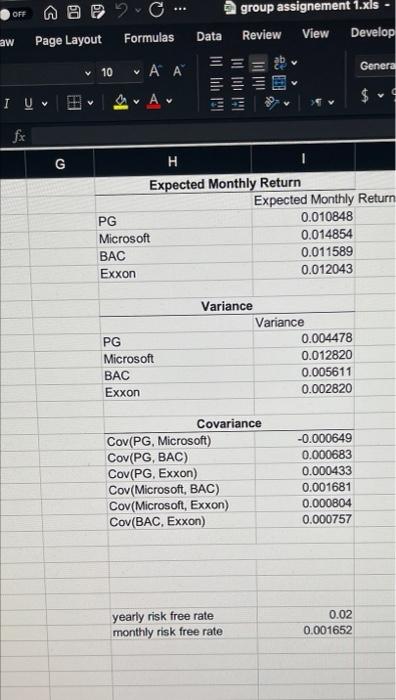

- CHE TE ST NE H Wet SE WIR THE AROLE CHE w CE CE TH TEL HP IH 400 . 2009 114 10000 . RICH FELES TIS 104 ER O BAR WHE FIL * w 361 BOT M 110 44 4 LISTS HOD 0 IT i NIERES OT MICE RONOV TES RE RIN . ter IN 004 GO IN CON WL Het GO DORT TE 9.90 O WE CH 41 LE LIRIK IM GO HOLE CH SM CHE NINI its D. IVET CS ST CON insial TU NSO twee E 2 13 DO W NE LI His TH 1104 LE HE CE . 3 PRIDE we BE CH 4la 40 . LES BRE BA 04 40 LE ICH 4.631 UE OUT WIDE - BG RID BE BO E FO 2011 w E HT OD D BESED BLIN PS WE LARE I RE THIS O SEE MO CI 14 RE Thaanaavaa F HE 3.147100 WE IT 12 HC + LE DOWS DOWE DO 10 YON 10 0.000 GE Dyp BD HD 1004700948458 . BB.CO 2.000 60 O IRIDOS SCRE dhe MS MO SOUT 100 4 ORE CANT POLE B002 0.000000 O Pie EPIT TOD 2006 0 BOLT 18 BE BAD to BOTTEN FOOD 000 BLR IL HD LE U 2.006478 PO G LOS GOS w Ver DEN the VOD WISHO LINE 2.00 OS CE RE 0 HO LO w I I ve 60.00 TO 0.01484 IVO RIEND HO TNINE WE 1000 1000 M PG HT ER OOTED BAC RO LA N M Expected Monthly Return Expected Monthly Retum PG 0.010848 Microsoft 0.014854 BAC 0.011589 Exxon 0.012043 Variance Variance PG Microsoft BAC Exxon 0.004478 0.01282 0.005611 0.00282 Covariance Cov/PG, Microsoft) Cov(PG, BAC) Cov/PG, Exxon) Cov/Microsoft, BAC) Cov/Microsoft Exxon) Cov(BAC. Econ) -0.000649 0.000683 0.000433 0.001681 0.000804 0.000757 c Group Assignment (please solve this question with brief details and formulas shown as well) For this assignment, please use excel file proup_assignment 1 portfoliosis posted on blackboard under the folder of Excel files. The file contains the monthly returns of 4 stocks over the 10 year period - January 1997 December 2006. In this file, the expected monthly return for each stock is calculated using excel function AVERAGE O. for each stock, the variance of monthly returns is calculated using Excel function VAR 0, and the covariance between the returns of each pair of stocks is calculated using Excel function COVARO. A that the yearly free of monthly rise free rate of 0.001652) Det the minimum warance frontier for an investor who wants to allocate his money to PGABAC, and the free Find the time of what are the mean and of the return of this portfolio For this assignment, please use excel file group assignment_1_portfolios.xls posted on blackboard under the folder of Excel Files. The file contains the monthly returns of 4 stocks over the 10 year period -- January 1997 - December 2006. In this file, the expected monthly return for each stock is calculated using excel function AVERAGE 0, for each stock, the variance of monthly returns is calculated using Excel function VAR 0, and the covariance between the returns of each pair of stocks is calculated using Excel function COVAR 0. Assume that the yearly risk free rate is 2% (A monthly risk free rate of 0.001652). (a) Plot the minimum variance frontier for an investor who wants to allocate his money to PG, BAC, and the risk-free asset. Find the optimal risky portfolio. What are the mean and s.d. of the returns of this portfolio? group assignement 1.xls - OFF 2. Formulas Data Review View Develop aw Page Layout General 10 INI ! Millil ilil V y I UB A G H Expected Monthly Return Expected Monthly Return PG 0.010848 Microsoft 0.014854 BAC 0.011589 Exxon 0.012043 PG Microsoft BAC Exxon Variance Variance 0.004478 0.012820 0.005611 0.002820 Covariance Cov(PG, Microsoft) Cov(PG, BAC) Cov(PG, Exxon) Cov(Microsoft, BAC) Cov(Microsoft, Exxon) Cov(BAC, Exxon) -0.000649 0.000683 0.000433 0.001681 0.000804 0.000757 yearly risk free rate monthly risk free rate 0.02 0.001652

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts