Question: please show your calculation steps clearly. Question 2 (18 marks) ABC Inc. is considering the following two mutually exclusive investment projects: Year 0 1 2

please show your calculation steps clearly.

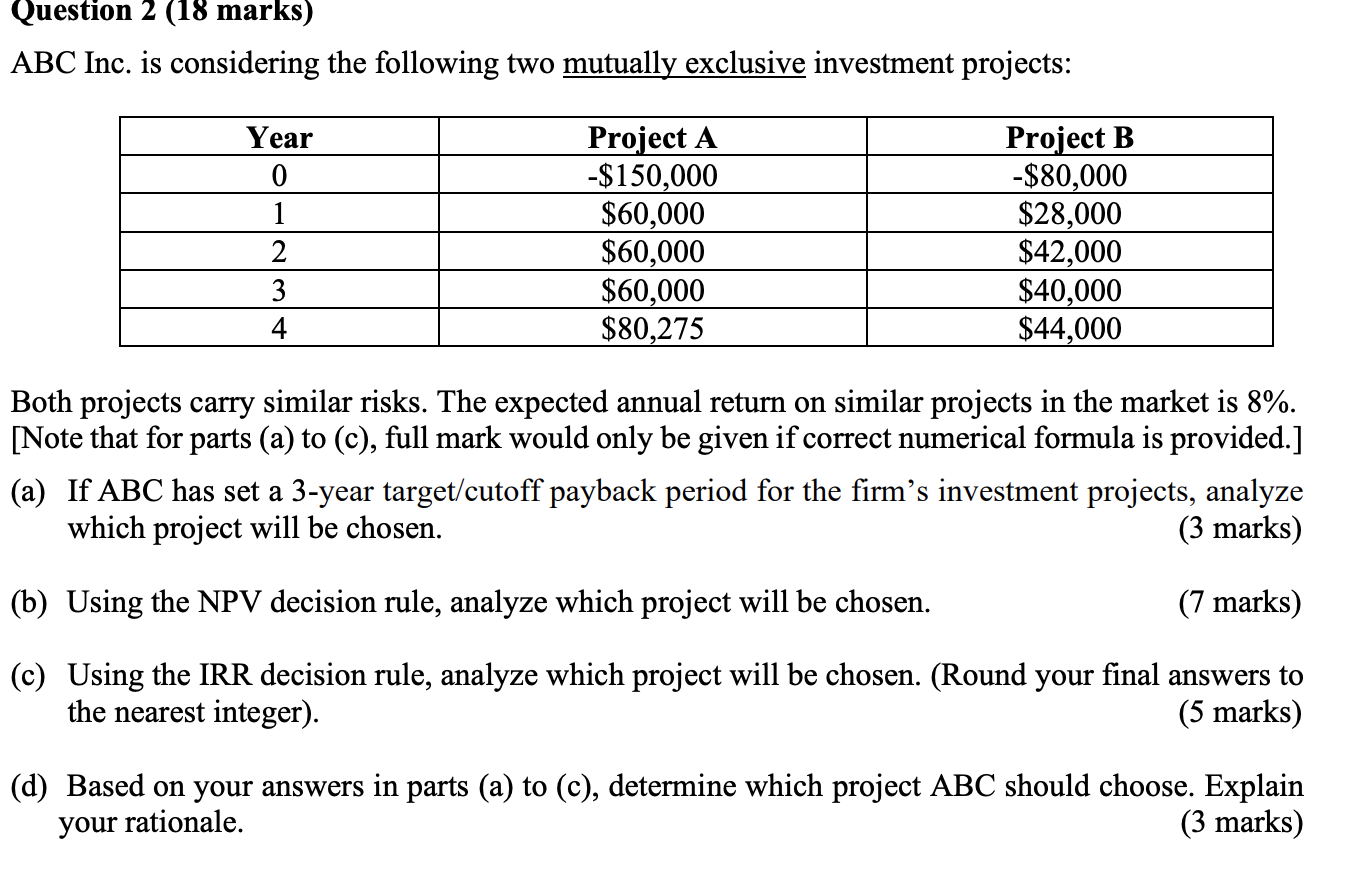

Question 2 (18 marks) ABC Inc. is considering the following two mutually exclusive investment projects: Year 0 1 2 3 4 Project A -$150,000 $60,000 $60,000 $60,000 $80,275 Project B -$80,000 $28,000 $42,000 $40,000 $44,000 Both projects carry similar risks. The expected annual return on similar projects in the market is 8%. [Note that for parts (a) to (c), full mark would only be given if correct numerical formula is provided.] (a) If ABC has set a 3-year target/cutoff payback period for the firm's investment projects, analyze which project will be chosen. (3 marks) (b) Using the NPV decision rule, analyze which project will be chosen. (7 marks) (c) Using the IRR decision rule, analyze which project will be chosen. (Round your final answers to the nearest integer). (5 marks) (d) Based on your answers in parts (a) to (c), determine which project ABC should choose. Explain (3 marks) your rationale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts