Question: Please show your work and I will give a thumbs up. Thank you! 5 You currently own 1,100 shares of JKL, Inc. JKL is currently

Please show your work and I will give a thumbs up. Thank you!

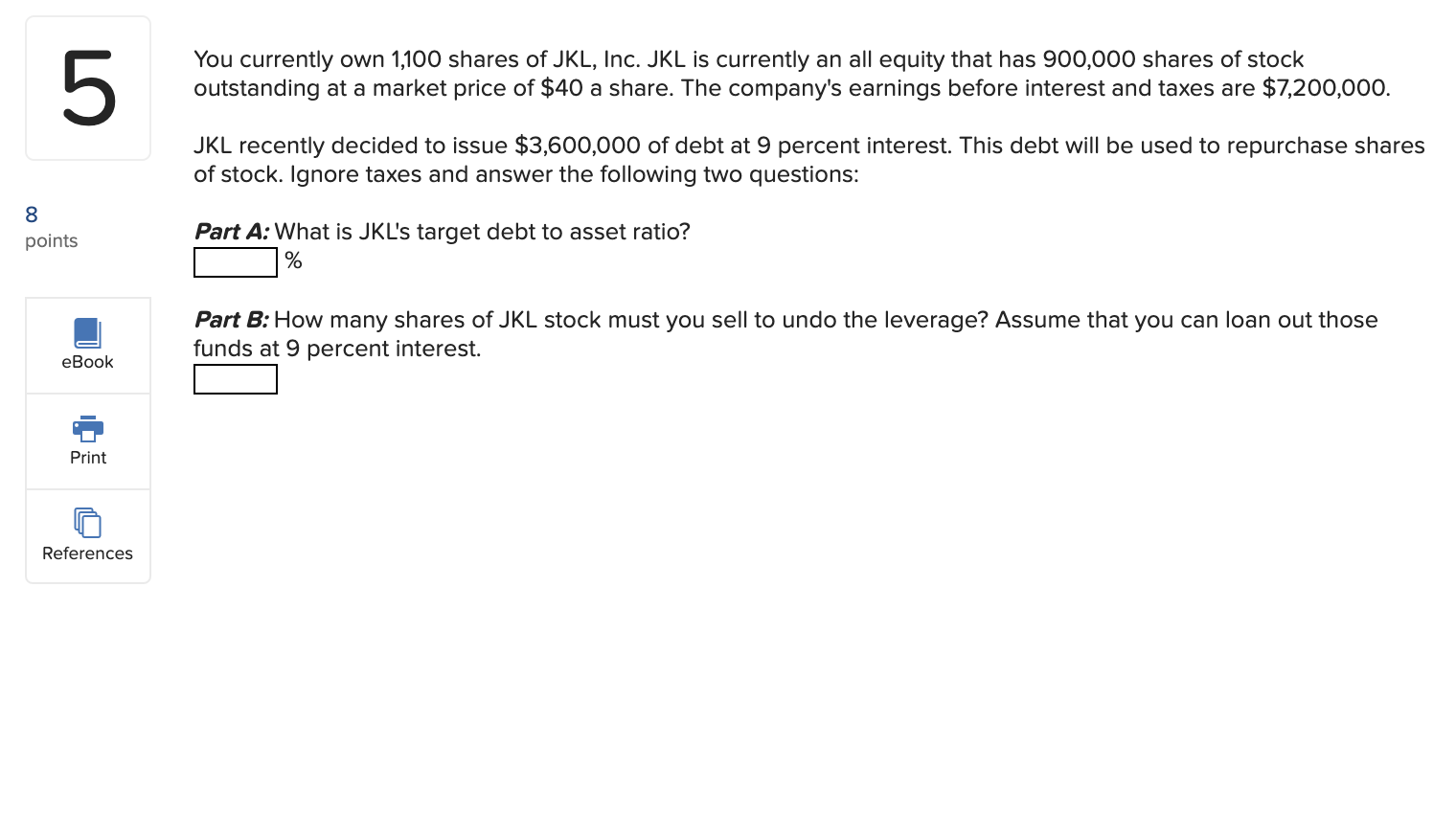

5 You currently own 1,100 shares of JKL, Inc. JKL is currently an all equity that has 900,000 shares of stock outstanding at a market price of $40 a share. The company's earnings before interest and taxes are $7,200,000. JKL recently decided to issue $3,600,000 of debt at 9 percent interest. This debt will be used to repurchase shares of stock. Ignore taxes and answer the following two questions: 8 points Part A: What is JKL's target debt to asset ratio? % Part B: How many shares of JKL stock must you sell to undo the leverage? Assume that you can loan out those funds at 9 percent interest. eBook Print References 5 You currently own 1,100 shares of JKL, Inc. JKL is currently an all equity that has 900,000 shares of stock outstanding at a market price of $40 a share. The company's earnings before interest and taxes are $7,200,000. JKL recently decided to issue $3,600,000 of debt at 9 percent interest. This debt will be used to repurchase shares of stock. Ignore taxes and answer the following two questions: 8 points Part A: What is JKL's target debt to asset ratio? % Part B: How many shares of JKL stock must you sell to undo the leverage? Assume that you can loan out those funds at 9 percent interest. eBook Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts