Question: Please show your work and I will give a thumbs up. Thank you! 9 Braxton Corp. currently has one million shares outstanding but no debt.

Please show your work and I will give a thumbs up. Thank you!

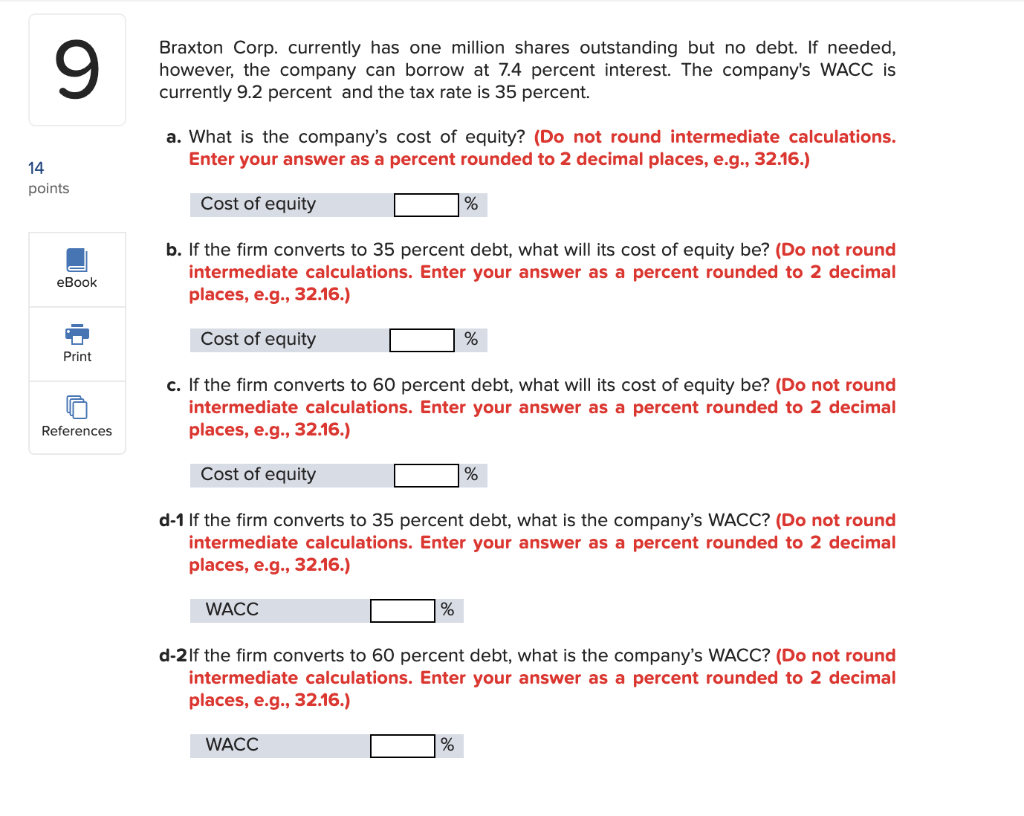

9 Braxton Corp. currently has one million shares outstanding but no debt. If needed, however, the company can borrow at 7.4 percent interest. The company's WACC is currently 9.2 percent and the tax rate is 35 percent. a. What is the company's cost of equity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 14 points Cost of equity % b. If the firm converts to 35 percent debt, what will its cost of equity be? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) eBook Cost of equity % Print c. If the firm converts to 60 percent debt, what will its cost of equity be? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) References Cost of equity % d-1 If the firm converts to 35 percent debt, what is the company's WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC % d-2 If the firm converts to 60 percent debt, what is the company's WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts