Question: please show your work and write it out 3. Marcotte Inc is considering a new automated production line project. The project has a cost of

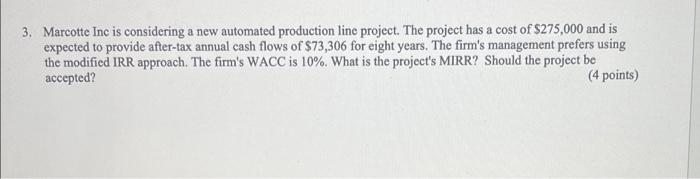

3. Marcotte Inc is considering a new automated production line project. The project has a cost of $275,000 and is expected to provide after-tax annual cash flows of $73,306 for eight years. The firm's management prefers using the modified IRR approach. The firm's WACC is 10%. What is the project's MIRR? Should the project be accepted? (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts