Question: Please show your work as well as the answer! Peter Nartez, the CEO of Riverside Manufacturing, is reviewing the possible acquisition of automated manufacturing equipment.

Please show your work as well as the answer!

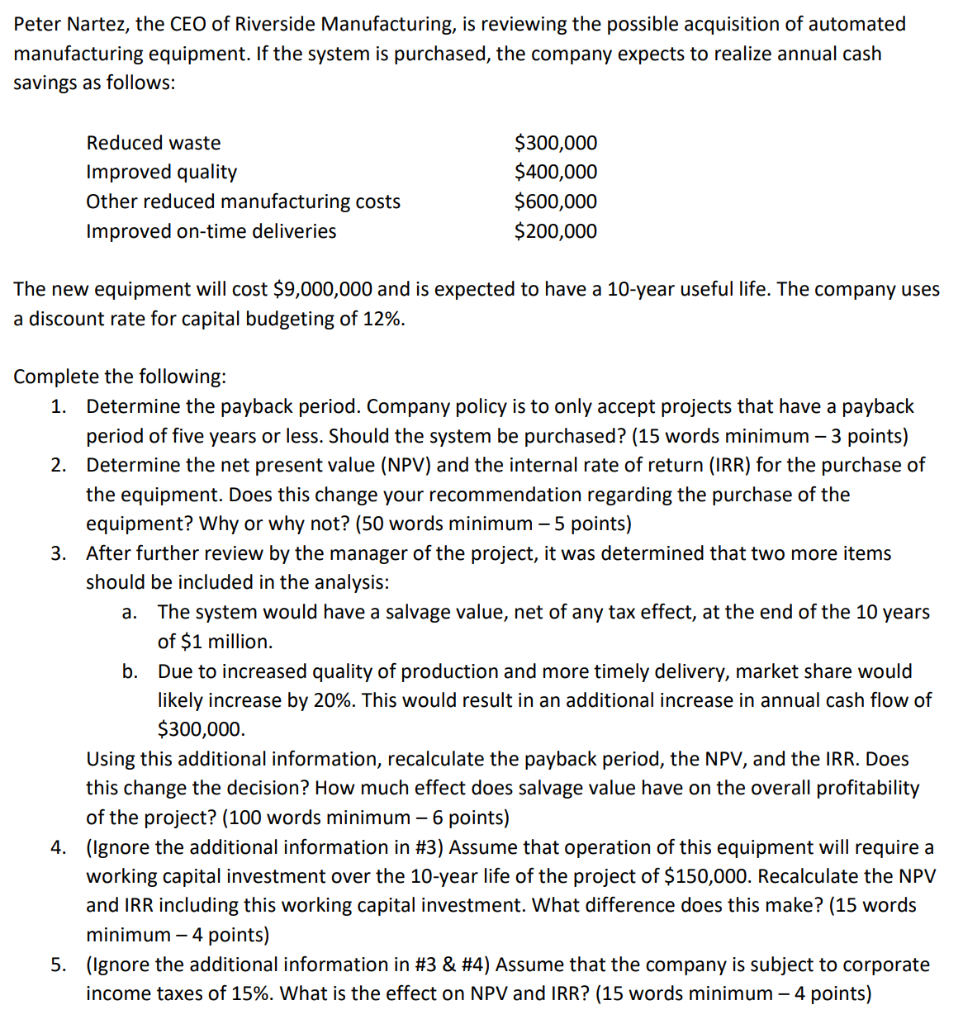

Peter Nartez, the CEO of Riverside Manufacturing, is reviewing the possible acquisition of automated manufacturing equipment. If the system is purchased, the company expects to realize annual cash savings as follows: Reduced waste Improved quality Other reduced manufacturing costs Improved on-time deliveries $300,000 $400,000 $600,000 $200,000 The new equipment will cost $9,000,000 and is expected to have a 10-year useful life. The company uses a discount rate for capital budgeting of 12%. a. Complete the following: 1. Determine the payback period. Company policy is to only accept projects that have a payback period of five years or less. Should the system be purchased? (15 words minimum - 3 points) 2. Determine the net present value (NPV) and the internal rate of return (IRR) for the purchase of the equipment. Does this change your recommendation regarding the purchase of the equipment? Why or why not? (50 words minimum - 5 points) 3. After further review by the manager of the project, it was determined that two more items should be included in the analysis: The system would have a salvage value, net of any tax effect, at the end of the 10 years of $1 million. b. Due to increased quality of production and more timely delivery, market share would likely increase by 20%. This would result in an additional increase in annual cash flow of $300,000. Using this additional information, recalculate the payback period, the NPV, and the IRR. Does this change the decision? How much effect does salvage value have on the overall profitability of the project? (100 words minimum 6 points) 4. (Ignore the additional information in #3) Assume that operation of this equipment will require a working capital investment over the 10-year life of the project of $150,000. Recalculate the NPV and IRR including this working capital investment. What difference does this make? (15 words minimum - 4 points) 5. (Ignore the additional information in #3 & #4) Assume that the company is subject to corporate income taxes of 15%. What is the effect on NPV and IRR? (15 words minimum - 4 points) Peter Nartez, the CEO of Riverside Manufacturing, is reviewing the possible acquisition of automated manufacturing equipment. If the system is purchased, the company expects to realize annual cash savings as follows: Reduced waste Improved quality Other reduced manufacturing costs Improved on-time deliveries $300,000 $400,000 $600,000 $200,000 The new equipment will cost $9,000,000 and is expected to have a 10-year useful life. The company uses a discount rate for capital budgeting of 12%. a. Complete the following: 1. Determine the payback period. Company policy is to only accept projects that have a payback period of five years or less. Should the system be purchased? (15 words minimum - 3 points) 2. Determine the net present value (NPV) and the internal rate of return (IRR) for the purchase of the equipment. Does this change your recommendation regarding the purchase of the equipment? Why or why not? (50 words minimum - 5 points) 3. After further review by the manager of the project, it was determined that two more items should be included in the analysis: The system would have a salvage value, net of any tax effect, at the end of the 10 years of $1 million. b. Due to increased quality of production and more timely delivery, market share would likely increase by 20%. This would result in an additional increase in annual cash flow of $300,000. Using this additional information, recalculate the payback period, the NPV, and the IRR. Does this change the decision? How much effect does salvage value have on the overall profitability of the project? (100 words minimum 6 points) 4. (Ignore the additional information in #3) Assume that operation of this equipment will require a working capital investment over the 10-year life of the project of $150,000. Recalculate the NPV and IRR including this working capital investment. What difference does this make? (15 words minimum - 4 points) 5. (Ignore the additional information in #3 & #4) Assume that the company is subject to corporate income taxes of 15%. What is the effect on NPV and IRR? (15 words minimum - 4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts