Question: Please show your work for each problem and bold/make clear the final answer. 1. Assume a firm owns a small warehouse. The warehouse is subject

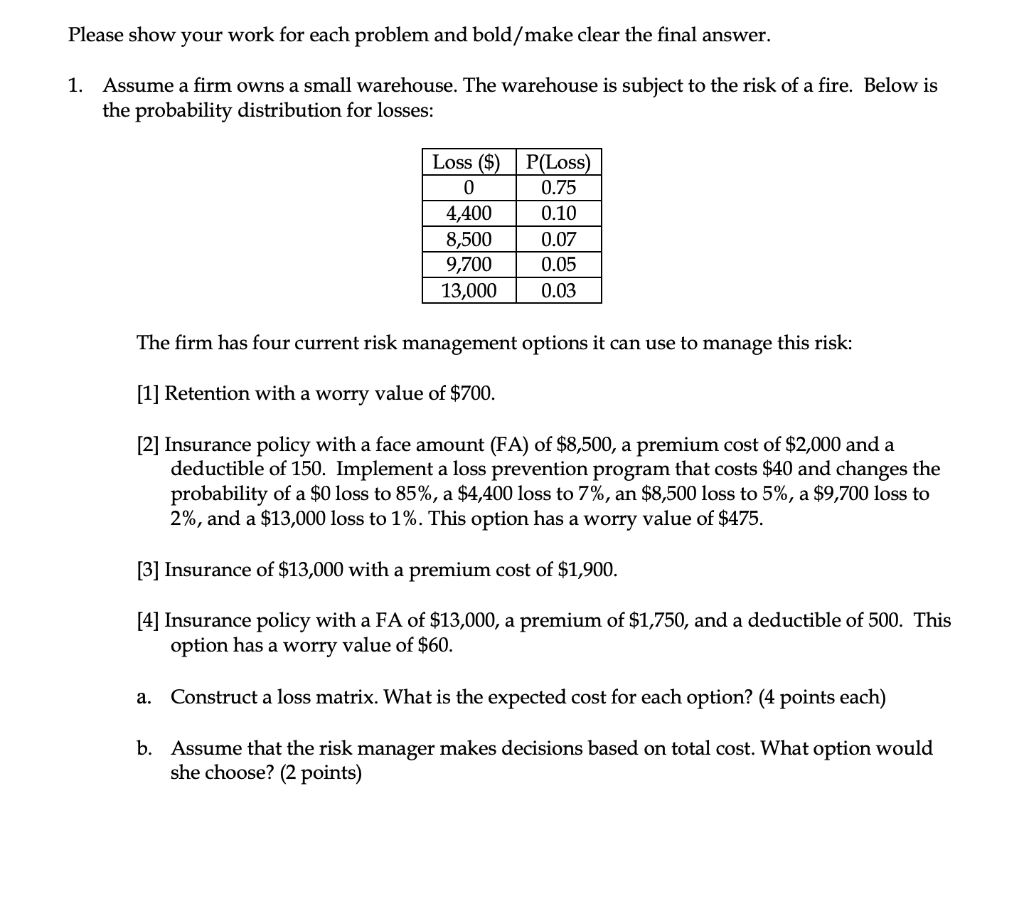

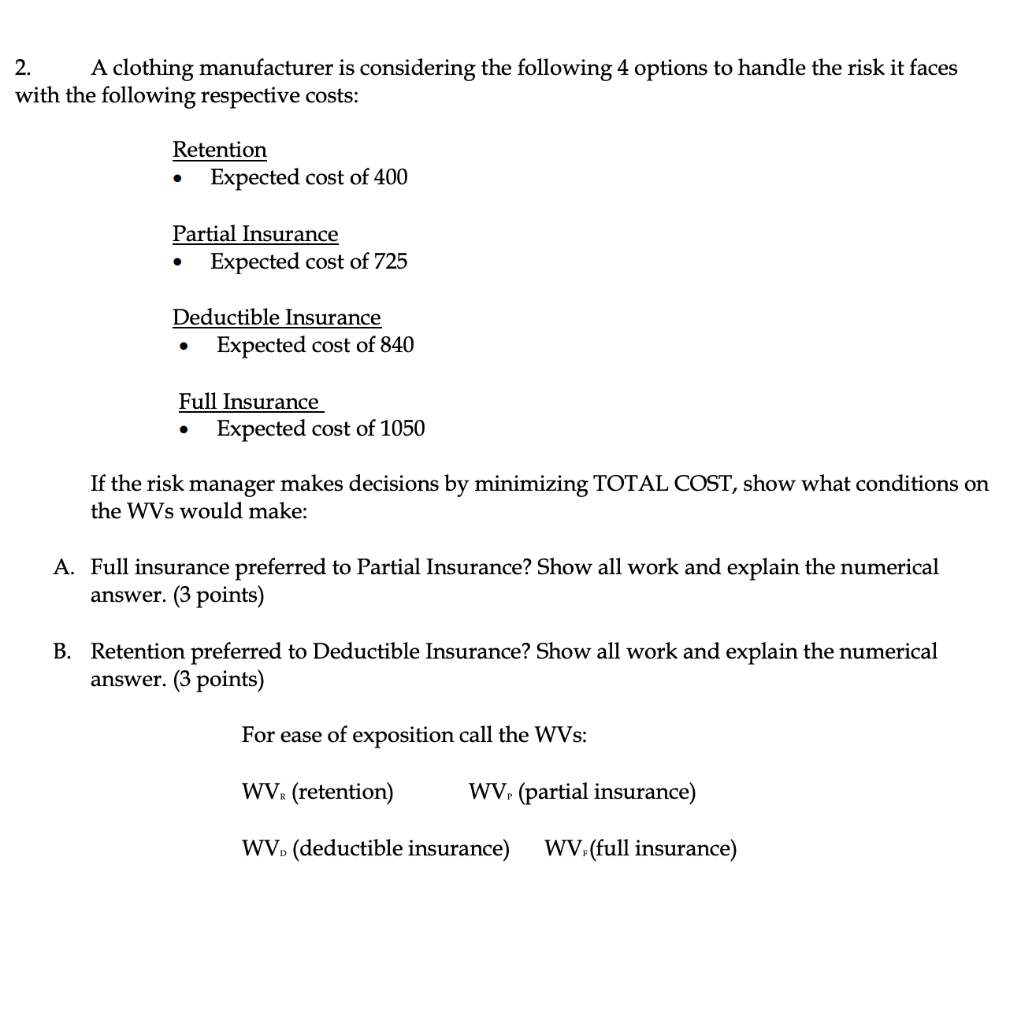

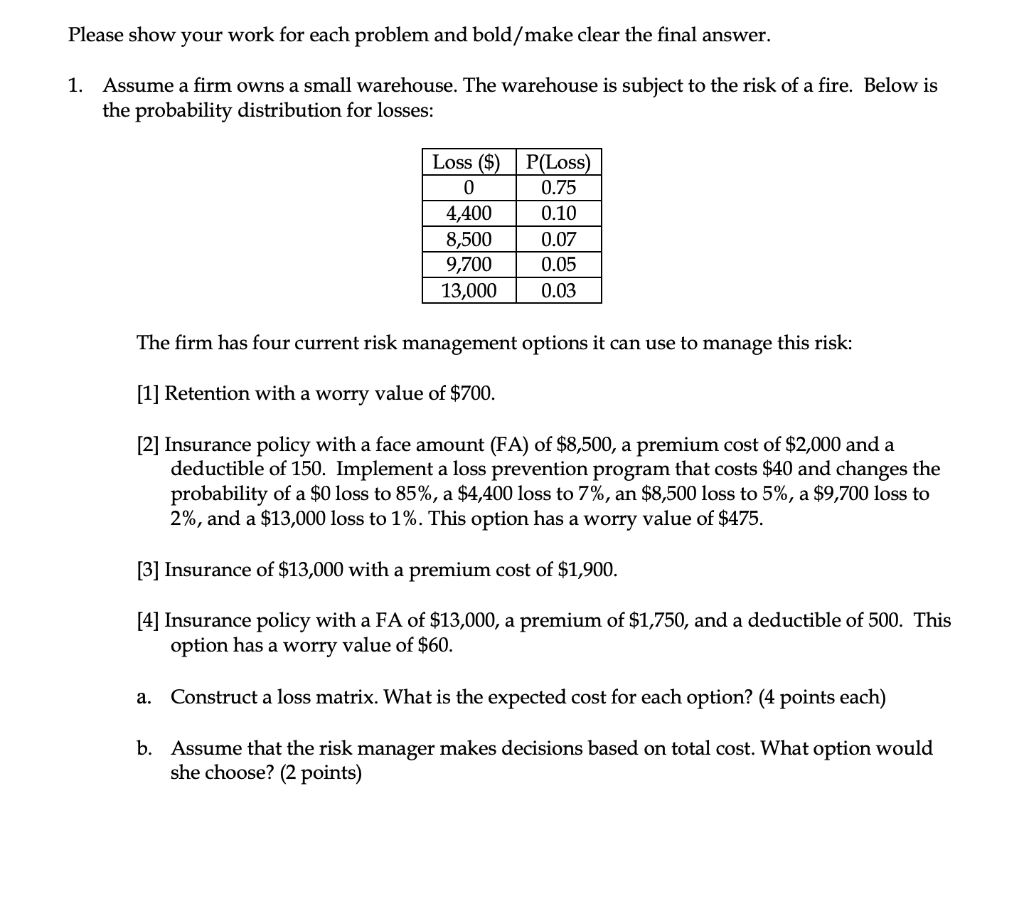

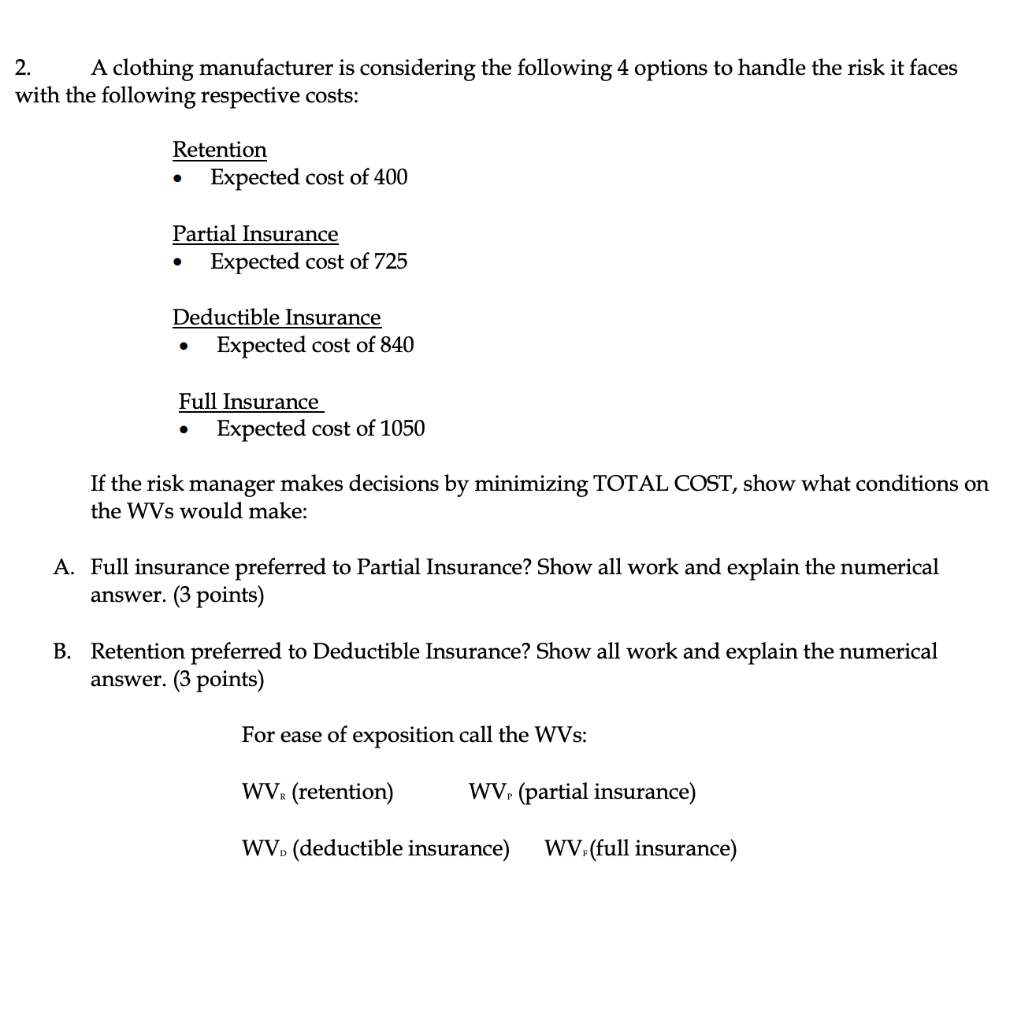

Please show your work for each problem and bold/make clear the final answer. 1. Assume a firm owns a small warehouse. The warehouse is subject to the risk of a fire. Below is the probability distribution for losses: Loss ($) 0 4,400 8,500 9,700 13,000 P(Loss) 0.75 0.10 0.07 0.05 0.03 The firm has four current risk management options it can use to manage this risk: [1] Retention with a worry value of $700. [2] Insurance policy with a face amount (FA) of $8,500, a premium cost of $2,000 and a deductible of 150. Implement a loss prevention program that costs $40 and changes the probability of a $0 loss to 85%, a $4,400 loss to 7%, an $8,500 loss to 5%, a $9,700 loss to 2%, and a $13,000 loss to 1%. This option has a worry value of $475. [3] Insurance of $13,000 with a premium cost of $1,900. [4] Insurance policy with a FA of $13,000, a premium of $1,750, and a deductible of 500. This option has a worry value of $60. a. Construct a loss matrix. What is the expected cost for each option? (4 points each) b. Assume that the risk manager makes decisions based on total cost. What option would she choose? (2 points) 2. A clothing manufacturer is considering the following 4 options to handle the risk it faces with the following respective costs: Retention Expected cost of 400 Partial Insurance Expected cost of 725 Deductible Insurance Expected cost of 840 . Full Insurance Expected cost of 1050 If the risk manager makes decisions by minimizing TOTAL COST, show what conditions on the WVs would make: A. Full insurance preferred to Partial Insurance? Show all work and explain the numerical answer. (3 points) B. Retention preferred to Deductible Insurance? Show all work and explain the numerical answer. (3 points) For ease of exposition call the WVs: WV. (retention) WV, (partial insurance) WV. (deductible insurance) WV (full insurance) Please show your work for each problem and bold/make clear the final answer. 1. Assume a firm owns a small warehouse. The warehouse is subject to the risk of a fire. Below is the probability distribution for losses: Loss ($) 0 4,400 8,500 9,700 13,000 P(Loss) 0.75 0.10 0.07 0.05 0.03 The firm has four current risk management options it can use to manage this risk: [1] Retention with a worry value of $700. [2] Insurance policy with a face amount (FA) of $8,500, a premium cost of $2,000 and a deductible of 150. Implement a loss prevention program that costs $40 and changes the probability of a $0 loss to 85%, a $4,400 loss to 7%, an $8,500 loss to 5%, a $9,700 loss to 2%, and a $13,000 loss to 1%. This option has a worry value of $475. [3] Insurance of $13,000 with a premium cost of $1,900. [4] Insurance policy with a FA of $13,000, a premium of $1,750, and a deductible of 500. This option has a worry value of $60. a. Construct a loss matrix. What is the expected cost for each option? (4 points each) b. Assume that the risk manager makes decisions based on total cost. What option would she choose? (2 points) 2. A clothing manufacturer is considering the following 4 options to handle the risk it faces with the following respective costs: Retention Expected cost of 400 Partial Insurance Expected cost of 725 Deductible Insurance Expected cost of 840 . Full Insurance Expected cost of 1050 If the risk manager makes decisions by minimizing TOTAL COST, show what conditions on the WVs would make: A. Full insurance preferred to Partial Insurance? Show all work and explain the numerical answer. (3 points) B. Retention preferred to Deductible Insurance? Show all work and explain the numerical answer. (3 points) For ease of exposition call the WVs: WV. (retention) WV, (partial insurance) WV. (deductible insurance) WV (full insurance)