Question: Please show your work for each problem or you will not receive credit. Please bold / make clear your final answer. Temple owns a small

Please show your work for each problem or you will not receive credit. Please boldmake clear your

final answer.

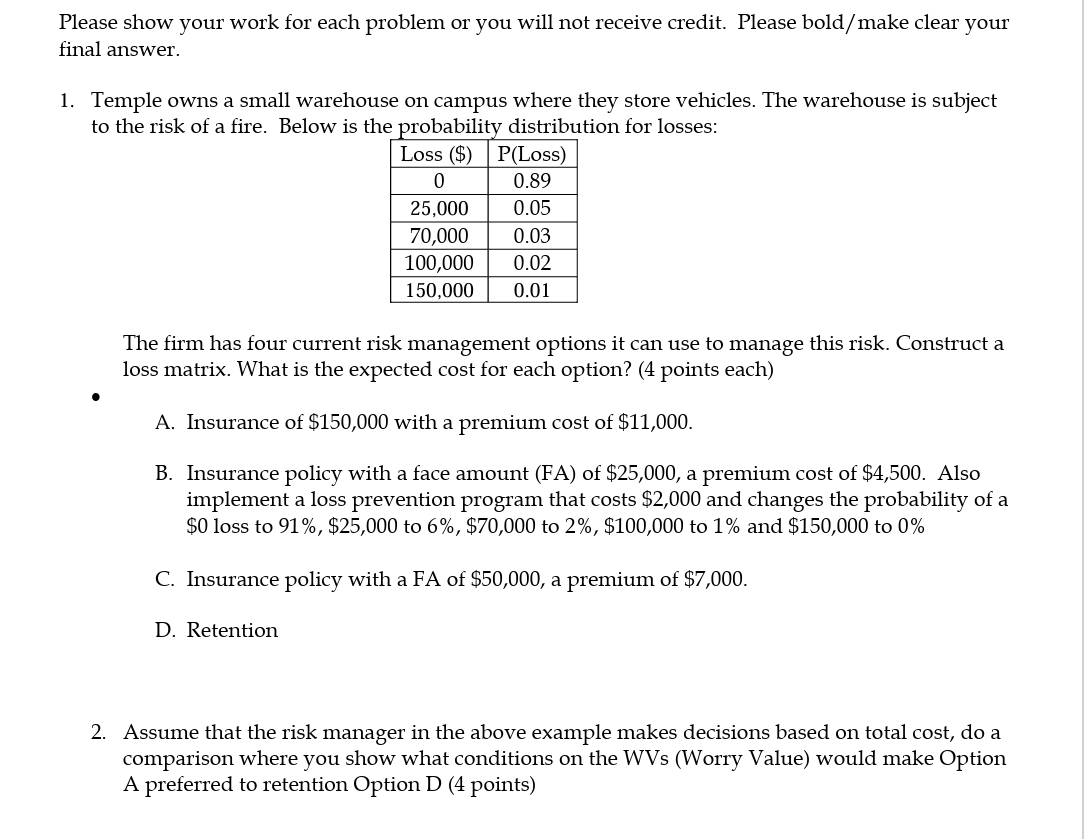

Temple owns a small warehouse on campus where they store vehicles. The warehouse is subject

to the risk of a fire. Below is the probability distribution for losses:

The firm has four current risk management options it can use to manage this risk. Construct a

loss matrix. What is the expected cost for each option? points each

A Insurance of $ with a premium cost of $

B Insurance policy with a face amount FA of $ a premium cost of $ Also

implement a loss prevention program that costs $ and changes the probability of a

$ loss to $ to $ to $ to and $ to

C Insurance policy with a FA of $ a premium of $

D Retention

Assume that the risk manager in the above example makes decisions based on total cost, do a

comparison where you show what conditions on the WVs Worry Value would make Option

A preferred to retention Option D points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock