Question: Please sir I don't want a previous solution from chegg I want a correct solution in the same way as this example please. My greetings.

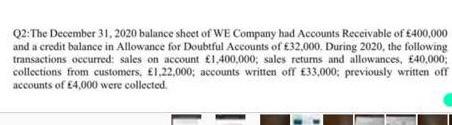

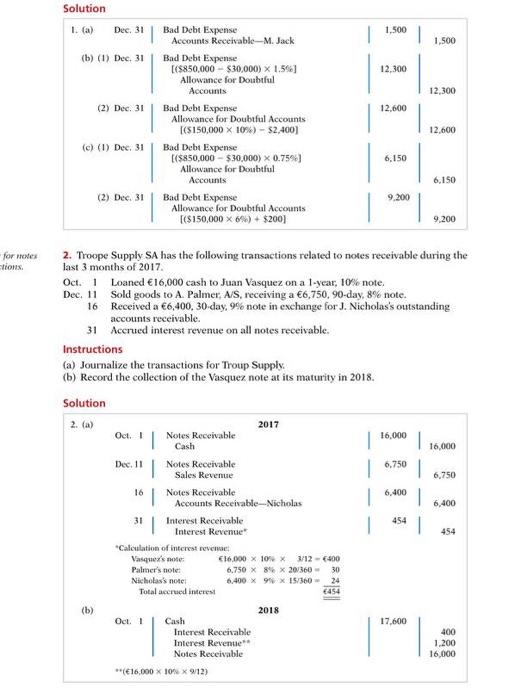

Q2: The December 31, 2020 balance sheet of WE Company had Accounts Receivable of 400,000 and a credit balance in Allowance for Doubtful Accounts of 32,000. During 2020. the following transactions occurred: sales on account 1,400.000, sales retums and allowances, 40,000 collections from customers. 1,22,000; accounts written off 33,000. previously written off accounts of 4,000 were collected Solution 1. (a) Dec, 31 1 1.500 1 1,500 (b) (1) Dec. 31 12.300 12,300 (2) Dec 31 12,600 Bad Debt Expense Accounts Receivable M. Jack Bad Debt Expense [{$850,000 - $30,000) x 1.56] Allowance for Doubtful Accounts Bad Debt Expense Allowance for Doubtful Accounts [(S150,000 X 10%) - $2,400) Bad Debt Expense [(5850,000 - $30,000) X 0.7596) Allowance for Doubtful Accounts Bad Debt Expense Allowance for Doubtful Accounts ($150,000 X 6%) + $200) 12,600 (c) (1) Dec 31 6,150 6.150 (2) Dec 31 9.200 9.200 for notes tions 2. Troope Supply SA has the following transactions related to notes receivable during the last 3 months of 2017 Oct. 1 Loaned 16,000 cash to Juan Vasquez on a 1-year, 10% note. Dec 11 Sold goods to A. Palmer A/S, receiving a 6,750, 90-day, 8% note. 16 Received a 6,400, 30-day, 9% note in exchange for J. Nicholas's outstanding accounts receivable. 31 Accrued interest revenue on all notes receivable. Instructions (a) Journalize the transactions for Troup Supply. (b) Record the collection of the Vasquez note at its maturity in 2018. Solution 2. (a) 2017 Oct. 1 Notes Receivable 16.000 Cash 1 16,000 Dec. 11 1 Notes Receivable 6,750 1 Sales Revenue 6.750 16 1 Notes Receivable 6,400 Accounts Receivable-Nicholas 6,400 31 Interest Receivable Interest Revenue 454 "Calculation of interest Raven Vasquez's not 16,000 X 10 X 3/12 - 400 Palmer's note: 6.750 X 8 X 20/360 - 30 Nicholas note 6,400 X 9 X 15/360 - 24 Total accrued interest 6454 (b) 2018 Oct. 1 Cash 17,600 Interest Receivable 400 Inter Revenue 1.200 Notes Receivable 16,000 (16,000 X 100 X 9/12) 154

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts