Question: Please solve 2, 3, 4 and 5. Thanks 2. During the year employee Sean Matthews eamed wages in the amount of $250,000 Discuss how the

Please solve 2, 3, 4 and 5. Thanks

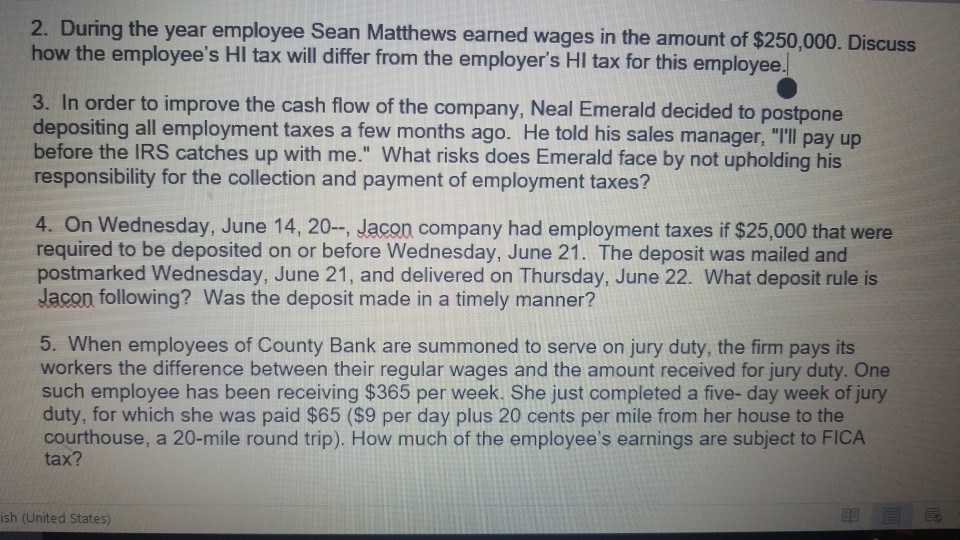

2. During the year employee Sean Matthews eamed wages in the amount of $250,000 Discuss how the employee's Hl tax will differ from the employer's HI tax for this employee. 3. In order to improve the cash flow of the company, Neal Emerald decided to postpone depositing all employment taxes a few months ago. He told his sales manager, "T'll pay up before the IRS catches up with me." What risks does Emerald face by not upholding his responsibility for the collection and payment of employment taxes? 4. On Wednesday, June 14, 20-, Jacon company had employment taxes if $25,000 that were required to be deposited on or before Wednesday, June 21. The deposit was mailed and postmarked Wednesday, June 21, and delivered on Thursday, June 22. What deposit rule is Jacon following? Was the deposit made in a timely manner? 5. When employees of County Bank are summoned to serve on jury duty, the firm pays its workers the difference between their regular wages and the amount received for jury duty. One such employee has been receiving $365 per week. She just completed a five- day week of jury duty, for which she was paid $65 ($9 per day plus 20 cents per mile from her house to the courthouse, a 20-mile round trip). How much of the employee's earnings are subject to FICA tax? ish (United States)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts