Question: Please solve 3 the data table below is correct P init cost 600,000,000 per room 800,000 price 500 vc 55 fixed costs 80 total costs

Please solve 3 the data table below is correct

P

| init cost | 600,000,000 |

| per room | 800,000 |

| price | 500 |

| vc | 55 |

| fixed costs | 80 |

| total costs | 135 |

| fixed costs (yr) | 21900000 |

| tax rate | 40% |

| coc | 11% |

| life | 40 |

| land | 150,000,000 |

| building | 450,000,000 |

| total | 600,000,000 |

| ann dep | 15,000,000 |

| tax savings | 6,000,000 |

| Pv tv | 200,000,000 |

| pv= | $52,162,755.44 |

| D= | $252,162,755.44 |

| pvifa | 8.951051 |

| q | $194,756.30 |

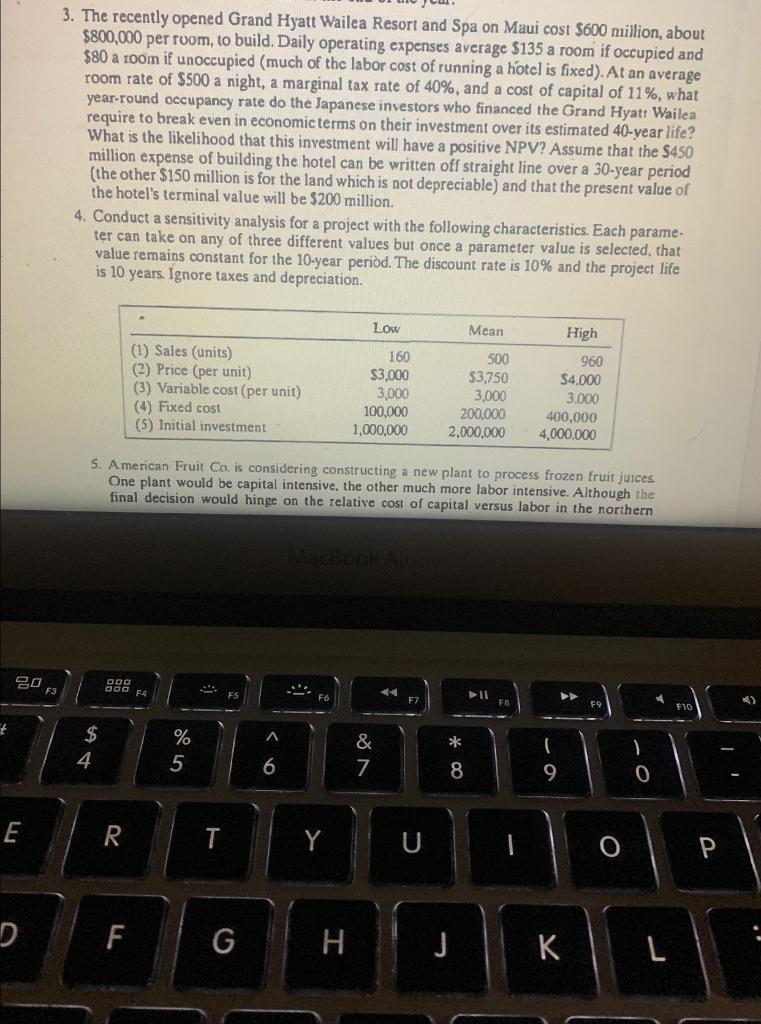

3. The recently opened Grand Hyatt Wailea Resort and Spa on Maui cost $600 million, about $800,000 per room, to build. Daily operating expenses average $135 a room if occupied and $80 a room if unoccupied (much of the labor cost of running a hotel is fixed). At an average room rate of $500 a night, a marginal tax rate of 40%, and a cost of capital of 11%, what year-round occupancy rate do the Japanese investors who financed the Grand Hyatt Wailea require to break even in economic terms on their investment over its estimated 40 -year life? What is the likelihood that this investment will have a positive NPV? Assume that the $450 million expense of building the hotel can be written off straight line over a 30-year period (the other $150 million is for the land which is not depreciable) and that the present value of the hotel's terminal value will be $200 million. 4. Conduct a sensitivity analysis for a project with the following characteristics. Each parameter can take on any of three different values but once a parameter value is selected, that value remains constant for the 10 -year period. The discount rate is 10% and the project life is 10 years. Ignore taxes and depreciation. 5. A merican Fruit Co. is considering constructing a new plant to process frozen fruit juices. One plant would be capital intensive, the other much more labor intensive. Although the final decision would hinge on the relative cost of capital versus labor in the northern 3. The recently opened Grand Hyatt Wailea Resort and Spa on Maui cost $600 million, about $800,000 per room, to build. Daily operating expenses average $135 a room if occupied and $80 a room if unoccupied (much of the labor cost of running a hotel is fixed). At an average room rate of $500 a night, a marginal tax rate of 40%, and a cost of capital of 11%, what year-round occupancy rate do the Japanese investors who financed the Grand Hyatt Wailea require to break even in economic terms on their investment over its estimated 40 -year life? What is the likelihood that this investment will have a positive NPV? Assume that the $450 million expense of building the hotel can be written off straight line over a 30-year period (the other $150 million is for the land which is not depreciable) and that the present value of the hotel's terminal value will be $200 million. 4. Conduct a sensitivity analysis for a project with the following characteristics. Each parameter can take on any of three different values but once a parameter value is selected, that value remains constant for the 10 -year period. The discount rate is 10% and the project life is 10 years. Ignore taxes and depreciation. 5. A merican Fruit Co. is considering constructing a new plant to process frozen fruit juices. One plant would be capital intensive, the other much more labor intensive. Although the final decision would hinge on the relative cost of capital versus labor in the northern

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts