Question: please solve 3. This question is about portfolio choice, CAPM, and market officiency (2 marks] a) 1 marks] Consider 5 stocks with returns given by

please solve

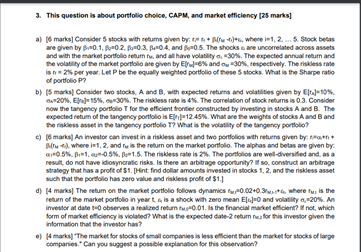

3. This question is about portfolio choice, CAPM, and market officiency (2 marks] a) 1 marks] Consider 5 stocks with returns given by the where i 1.2. ... 5 Stock betas are given by 20.1.-02.0.3.0.4 and 0.5. The shocks are un correlated across assets and with the market portfolio retum, and all have volatility -30%. The expected annual retum and the volatility of the market portfolio are given by E8% and 30%, respectively. The riskless rate IS2% per year. Let P be the equally weighted portfolio of these stocks. What is the Sharpe ratio of portfolio P2 b) 5 marksConsider two stocks. A and B with expected returns and volatitis given by El.)- 10% -20%, 15%,30%. The riskless rate is 45. The correlation of stock returns is 03.0 now the tangency portfolio for the efficient frontier constructed by investing in stocks A and B. The expected return of the tangency portfolio is El-12.45%. What are the weights of stocks A and B and the riskless set in the tangency portfolio T What is the volatility of the tangency portfolio? c) 18 marks) An investor can invest in a riskless and two portfolios with returns given by Be where I 1, 2 and is the return on the market portfolio The alphas and belas are given by 0.5%.1.0.5% Dow 1.5. The riskless rate is 2%. The portfolios are well-diversified and as a result do not have idiosyncratic risks. Is there an arbitrage opportunity to construct an arbitrage strategy that has a proft of $1. [Hint find dollar amounts invested in stocks 1, 2, and the riskless asset such that the portfolio has zero value and riskless profit of $1.1 d) 14 marks| The return on the market portfolio follows dynamics 20.02+0.3s where is the return of the market portfolio in year is a shock with zero mean [4] and volatility -20%. An investor at date observes a realized retum-0.01, is the financial market fint not, which form of marketeiciency is violated? What is the expected date-2 retum Tuy for this investor given the Information that the investor has? .) 4 marks the market for stocks of small companies is less efficient than the market for stocks of large companies. Can you suggest a possible explanation for this observation 3. This question is about portfolio choice, CAPM, and market officiency (2 marks] a) 1 marks] Consider 5 stocks with returns given by the where i 1.2. ... 5 Stock betas are given by 20.1.-02.0.3.0.4 and 0.5. The shocks are un correlated across assets and with the market portfolio retum, and all have volatility -30%. The expected annual retum and the volatility of the market portfolio are given by E8% and 30%, respectively. The riskless rate IS2% per year. Let P be the equally weighted portfolio of these stocks. What is the Sharpe ratio of portfolio P2 b) 5 marksConsider two stocks. A and B with expected returns and volatitis given by El.)- 10% -20%, 15%,30%. The riskless rate is 45. The correlation of stock returns is 03.0 now the tangency portfolio for the efficient frontier constructed by investing in stocks A and B. The expected return of the tangency portfolio is El-12.45%. What are the weights of stocks A and B and the riskless set in the tangency portfolio T What is the volatility of the tangency portfolio? c) 18 marks) An investor can invest in a riskless and two portfolios with returns given by Be where I 1, 2 and is the return on the market portfolio The alphas and belas are given by 0.5%.1.0.5% Dow 1.5. The riskless rate is 2%. The portfolios are well-diversified and as a result do not have idiosyncratic risks. Is there an arbitrage opportunity to construct an arbitrage strategy that has a proft of $1. [Hint find dollar amounts invested in stocks 1, 2, and the riskless asset such that the portfolio has zero value and riskless profit of $1.1 d) 14 marks| The return on the market portfolio follows dynamics 20.02+0.3s where is the return of the market portfolio in year is a shock with zero mean [4] and volatility -20%. An investor at date observes a realized retum-0.01, is the financial market fint not, which form of marketeiciency is violated? What is the expected date-2 retum Tuy for this investor given the Information that the investor has? .) 4 marks the market for stocks of small companies is less efficient than the market for stocks of large companies. Can you suggest a possible explanation for this observation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts