Question: Could someone help me with b)? The answer for a) is: (A) Given, Beta of mutual fund: 1.5 Expected Return of mutual fund: 9% Risk

Could someone help me with b)?

The answer for a) is: (A)

Given,

Beta of mutual fund: 1.5

Expected Return of mutual fund: 9%

Risk free rate 1%

Market Return 5%

1) Fund's Alpha

Alpha = Expected return - CAPM return

CAPM return = risk free rate + Beta (Market return - risk free

return)=0.01 + 1.5*(0.05-0.01)

CAPM return = risk free rate + Beta (Market return - risk free

return)=0.01 + 1.5*(0.05-0.01) 7.00%

Alpha = 9% - 7% = 2%

2) Yes, we should invest in a fund as it is generating positive

alpha that means it is generating returns higher than the systematic risk

involved in the fund due to superior investing.

3) Passive portfolio

As passive portfolio is a porfolio based on market index. Beta

of such passive portfolio invested 100% in the market is 1. The required beta

of the mutual fund is 1.5 so this portfolio needs to be invested more in market

by borrowing at risk free rate.

So to get the beta of 1.5 foloowing weights are required:

150% on market portfolio

-50% on riskfree asset

4) Return on passive portfolio

Return = 1.5*(5%) -0.5*(1%) = 7%

5) Difference between the returns:

Difference = Expected return on mutual fund - Expected Return on

passive fund = 9% - 7% = 2%

This difference arises because mutual fund is generating higher

return than the systematic return undertaken because of positive alpha but the

passive fund is just generating the required return according to the level of

the systematic risk undertaken.

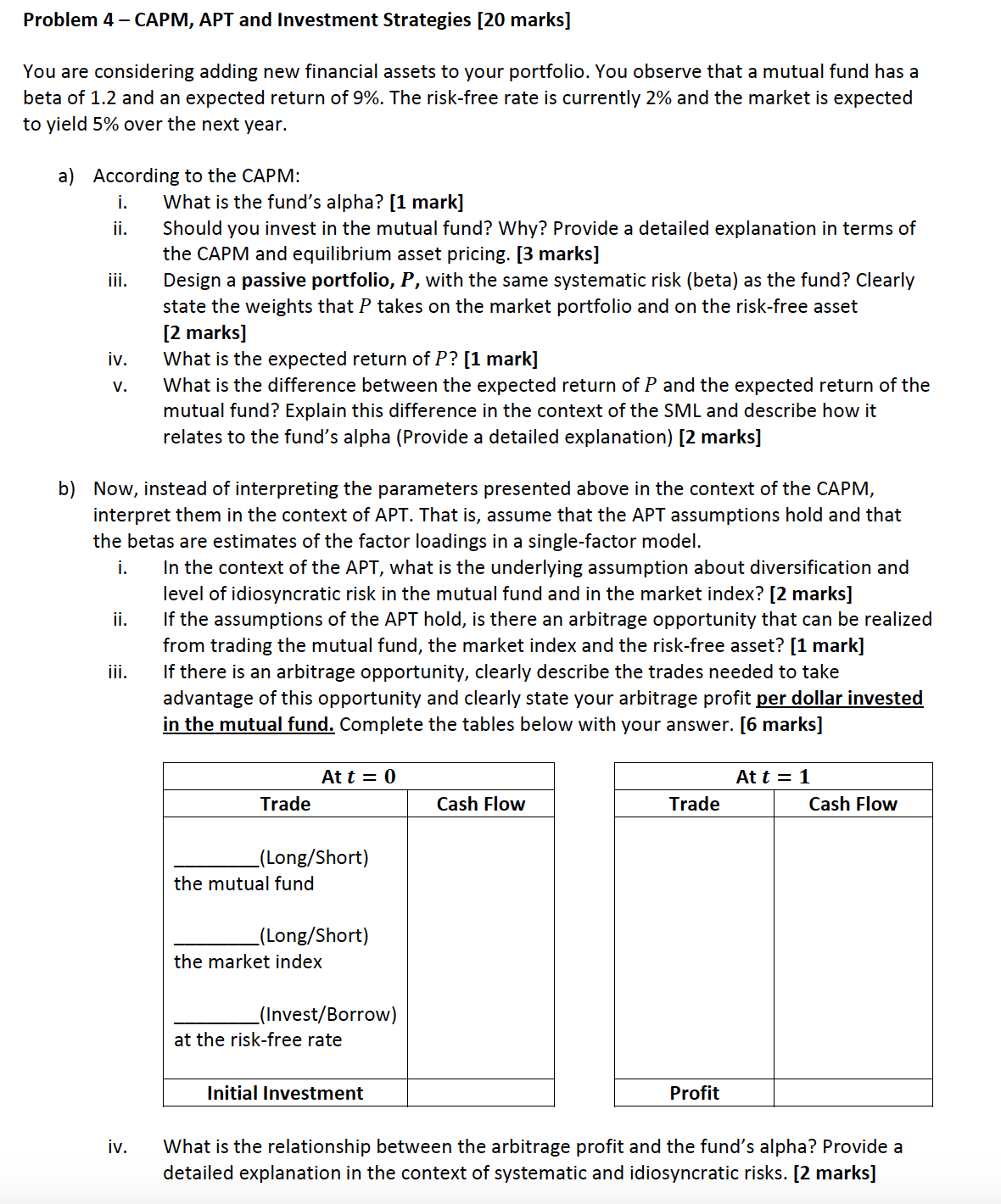

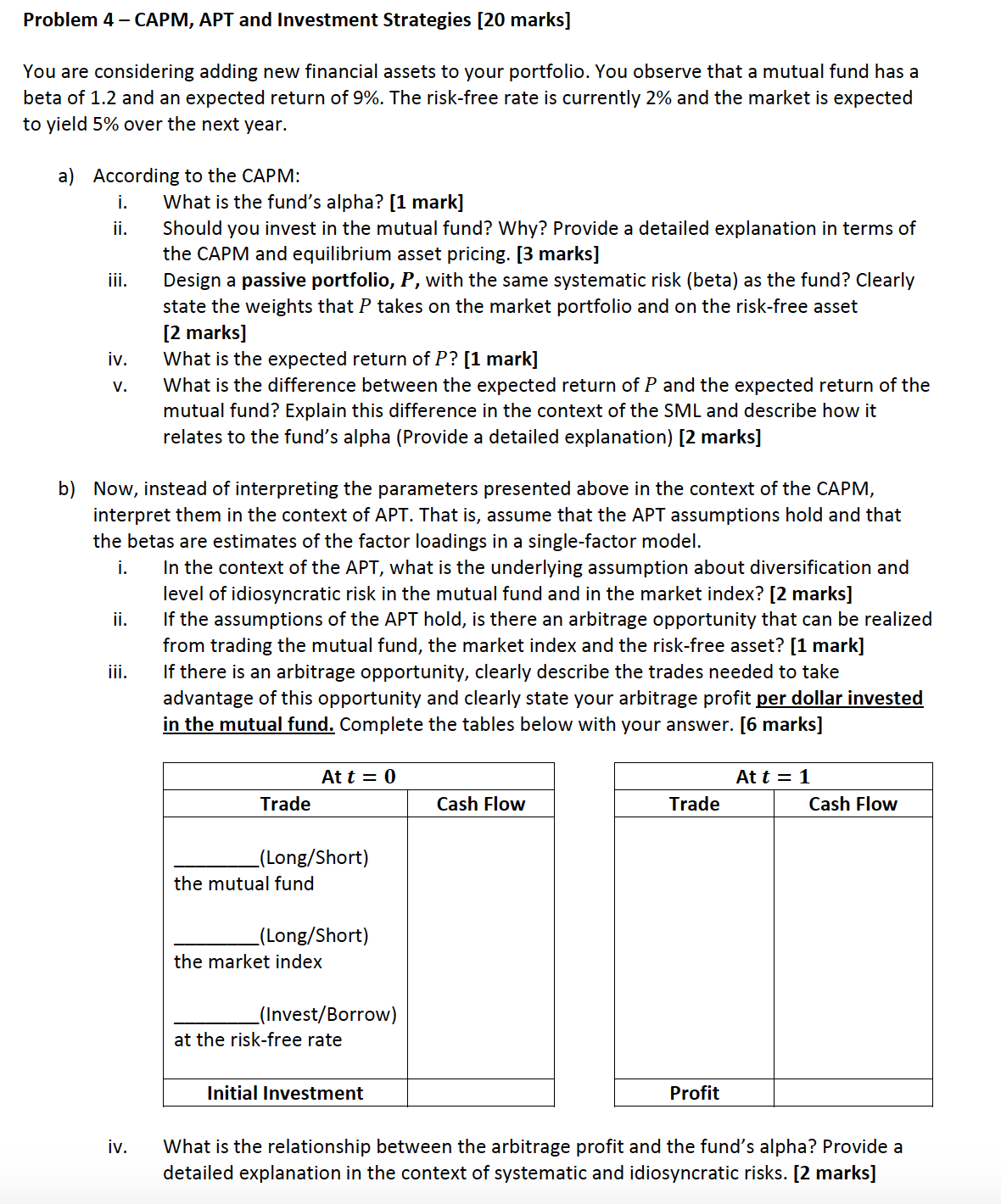

Problem 4 CAPM, APT and Investment Strategies [20 marks] You are considering adding new financial assets to your portfolio. You observe that a mutual fund has a beta of 1.2 and an expected return of 9%. The risk-free rate is currently 2% and the market is expected to yield 5% over the next yea r. a) According to the CAPM: iv. What is the fund's alpha? [1 mark] Should you invest in the mutual fund? Why? Provide a detailed explanation in terms of the CAPM and equilibrium asset pricing. [3 marks] Design a passive portfolio, P, with the same systematic risk (beta) as the fund? Clearly state the weights that P takes on the market portfolio and on the risk-free asset [2 marks] What is the expected return ofP? [1 mark] What is the difference between the expected return of P and the expected return of the mutual fund? Explain this difference in the context of the SML and describe how it relates to the fund's alpha (Provide a detailed explanation) [2 marks] b) Now, instead of interpreting the parameters presented above in the context of the CAPM, interpret them in the context of APT. That is, assume that the APT assumptions hold and that the betas are estimates of the factor loadings in a single-factor model. iv. In the context of the APT, what is the underlying assumption about diversification and level of idiosyncratic risk in the mutual fund and in the market index? [2 marks] If the assumptions of the APT hold, is there an arbitrage opportunity that can be realized from trading the mutual fund, the market index and the risk-free asset? [1 mark] If there is an arbitrage opportunity, clearly describe the trades needed to take advantage ofthis opportunity and clearly state your arbitrage profit per dollar invested in the mutual fund. Complete the tables below with your answer. [6 marks] At t = 0 At t = 1 Trade Cash Flow Trade Cash Flow (Long/Short) the mutual fund (Long/Short) the market index (lnvest/ Borrow) at the risk-free rate Initial Investment Profit What is the relationship between the arbitrage profit and the fund's alpha? Provide a detailed explanation in the context of systematic and idiosyncratic risks. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts