Question: Please solve 4th and 5th answer and Do not Use ChatGPT and Chegg answers.. Please solve 4th and 5th questions shown below.. Consider a discrete-time

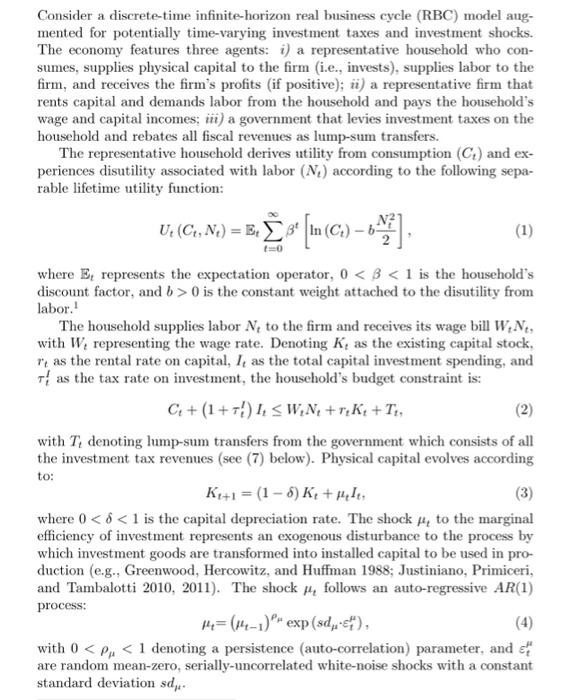

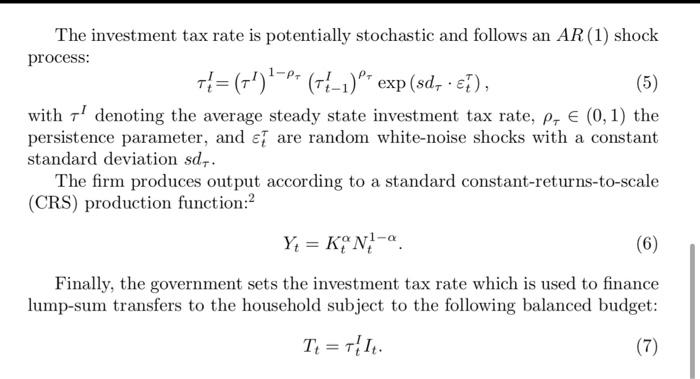

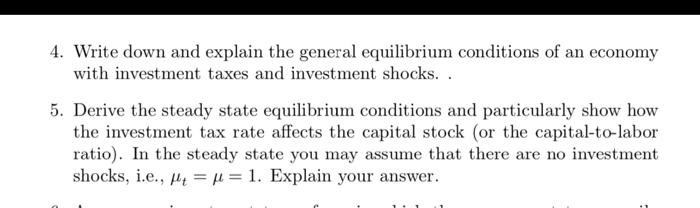

Consider a discrete-time infinite-horizon real business cycle (RBC) model augmented for potentially time-varying investment taxes and investment shocks. The economy features three agents: i) a representative household who consumes, supplies physical capital to the firm (i.e., invests), supplies labor to the firm, and receives the firm's profits (if positive); ii) a representative firm that rents capital and demands labor from the household and pays the household's wage and capital incomes; iii) a government that levies investment taxes on the household and rebates all fiscal revenues as lump-sum transfers. The representative household derives utility from consumption (Ct) and experiences disutility associated with labor (Nt) according to the following separable lifetime utility function: Ut(Ct,Nt)=Ett=0t[ln(Ct)b2Nt2], where Et represents the expectation operator, 00 is the constant weight attached to the disutility from labor. 1 The household supplies labor Nt to the firm and receives its wage bill WtNt, with Wt representing the wage rate. Denoting Kt as the existing capital stock. rt as the rental rate on capital, It as the total capital investment spending, and tI as the tax rate on investment, the household's budget constraint is: Ct+(1+tI)ItWtNt+rtKt+Tt with Tt denoting lump-sum transfers from the government which consists of all the investment tax revenues (see (7) below). Physical capital evolves according to: Kt+1=(1)Kt+tIt, where 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts