Question: please i need help with question 4 using excel and the formulas to get the answers b. What is the value of the shareholders' equity

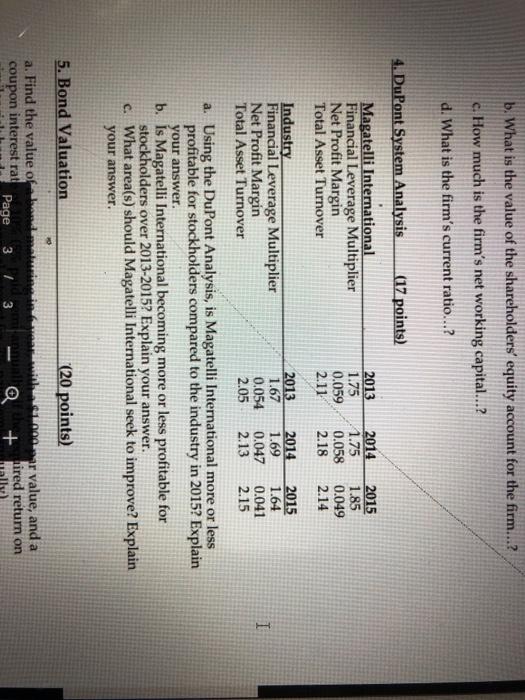

b. What is the value of the shareholders' equity account for the firm...? c. How much is the firm's net working capital...? d. What is the firm's current ratio...? 4. DuPont System Analysis (17 points) Magatelli International Financial Leverage Multiplier Net Profit Margin Total Asset Turnover 2013 1.75 0.059 2.11 2014 1.75 0.058 2.18 2015 1.85 0.049 2.14 Industry Financial Leverage Multiplier Net Profit Margin Total Asset Turnover 2013 1.67 0.054 2.05 2014 1.69 0.047 2.13 2015 1.64 0.041 2.15 I a. Using the DuPont Analysis, is Magatelli International more or less profitable for stockholders compared to the industry in 2015? Explain your answer. b. Is Magatelli International becoming more or less profitable for stockholders over 2013-2015? Explain your answer. c. What area(s) should Magatelli International seek to improve? Explain your answer. 5. Bond Valuation (20 points) a. Find the value of and coupon interest rat Page ar value, and a tired return on 3 / 3 a +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts