Question: please solve 5.7, 5.8 and 5.9 thanks! Calculating Present Values 5.7 Imprudential Inc. has an unfunded pension liability of $750 million that must be paid

please solve 5.7, 5.8 and 5.9

thanks!

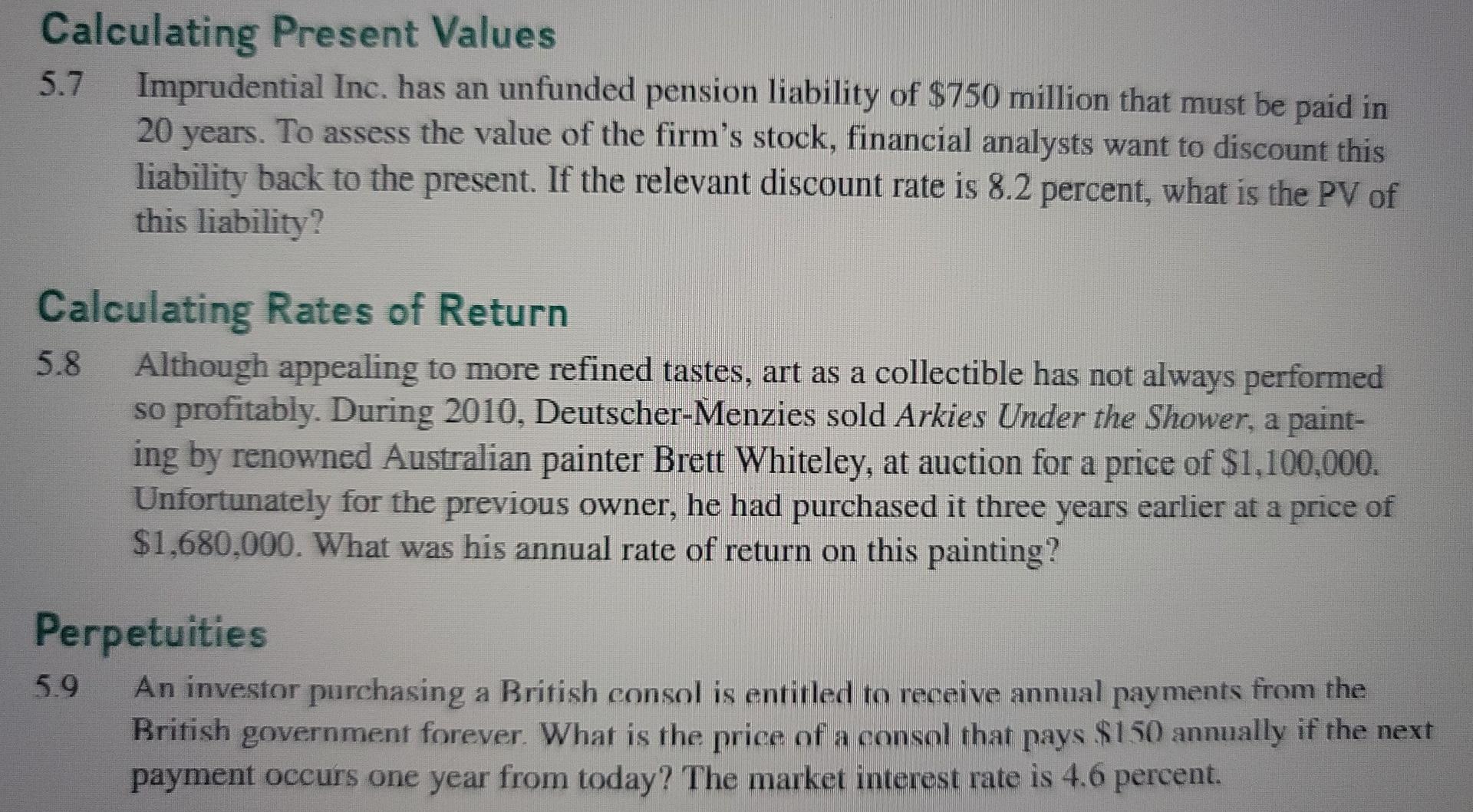

Calculating Present Values 5.7 Imprudential Inc. has an unfunded pension liability of $750 million that must be paid in 20 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 8.2 percent, what is the PV of this liability? Calculating Rates of Return 5.8 Although appealing to more refined tastes, art as a collectible has not always performed so profitably. During 2010, Deutscher-Menzies sold Arkies Under the Shower, a paint- ing by renowned Australian painter Brett Whiteley, at auction for a price of $1,100,000. Unfortunately for the previous owner, he had purchased it three years earlier at a price of $1,680,000. What was his annual rate of return on this painting? Perpetuities 5.9 An investor purchasing a British consol is entitled to receive annual payments from the British government forever. What is the price of a consol that pays $150 annually if the next payment occurs one year from today? The market interest rate is 4.6 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts