Question: please solve a b c and d. Question 2: (a) (6 points) What is a lower bound for the price of an at-the-money one-year Euro-

please solve a b c and d.

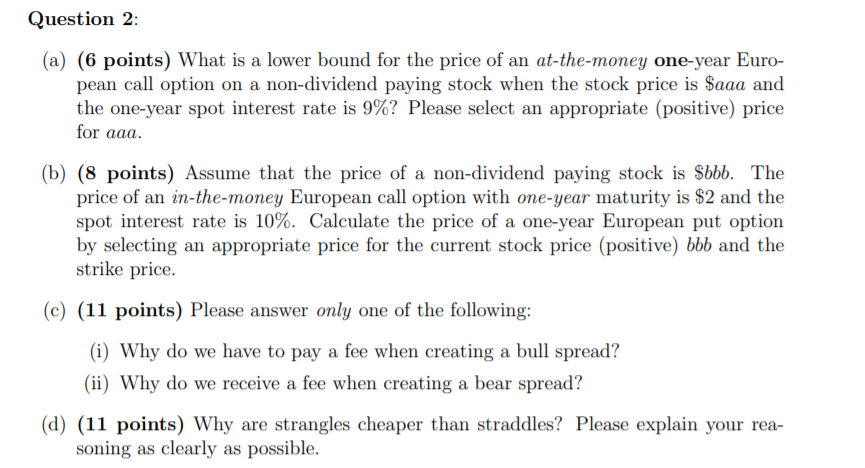

Question 2: (a) (6 points) What is a lower bound for the price of an at-the-money one-year Euro- pean call option on a non-dividend paying stock when the stock price is $aaa and the one-year spot interest rate is 9%? Please select an appropriate (positive price for aaa. (b) (8 points) Assume that the price of a non-dividend paying stock is $bbb. The price of an in-the-money European call option with one-year maturity is $2 and the spot interest rate is 10%. Calculate the price of a one-year European put option by selecting an appropriate price for the current stock price positive) bbb and the strike price. (c) (11 points) Please answer only one of the following: (i) Why do we have to pay a fee when creating a bull spread? (ii) Why do we receive a fee when creating a bear spread? (d) (11 points) Why are strangles cheaper than straddles? Please explain your rea- soning as clearly as possible. Question 2: (a) (6 points) What is a lower bound for the price of an at-the-money one-year Euro- pean call option on a non-dividend paying stock when the stock price is $aaa and the one-year spot interest rate is 9%? Please select an appropriate (positive price for aaa. (b) (8 points) Assume that the price of a non-dividend paying stock is $bbb. The price of an in-the-money European call option with one-year maturity is $2 and the spot interest rate is 10%. Calculate the price of a one-year European put option by selecting an appropriate price for the current stock price positive) bbb and the strike price. (c) (11 points) Please answer only one of the following: (i) Why do we have to pay a fee when creating a bull spread? (ii) Why do we receive a fee when creating a bear spread? (d) (11 points) Why are strangles cheaper than straddles? Please explain your rea- soning as clearly as possible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts