Question: please solve a through c. please show how you calculated each number. please solve a through c. please show how you calculated each number. megiaired

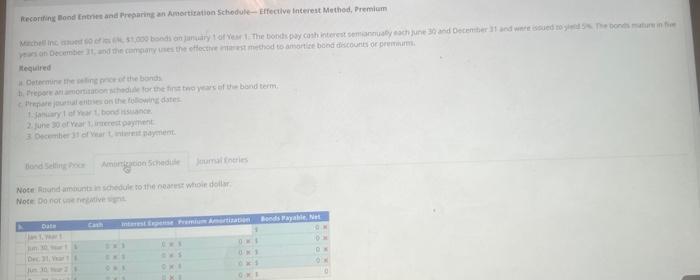

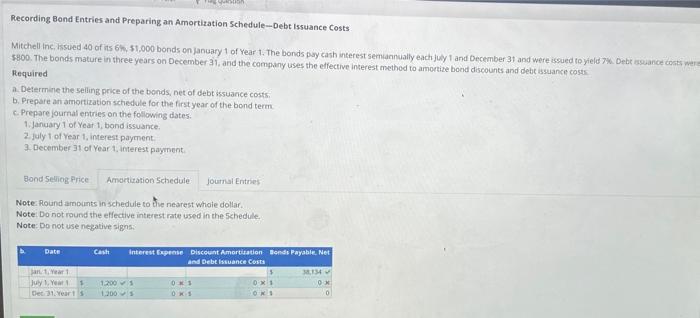

megiaired 2. Whe 20 ef Year 1 inueret payiunt 3. Pecriber if of vear t. micinit maynient. Recording Bond Entries and Preparing an Amortization Schedule-Debt Issuance Costs Mitchell ine. Issued 40 of its 6%,51,000 bonds onjanuary 1 of Year t. The bonds pay cash interest semannually eachijuly 1 and December 31 and were issued te yield 7% Debt iseuance conts wer. \$800. The bonds mature in three years on December 31 , and the company uses the effective interest method to amortize bocd discounts and debe issuance costs Required a. Determine the seling price of the bonds, net of debt issuance contsi. b. Prepare an amortization schedule for the first year of the bond term c. Prepare journal entries on the following dates. 1. January 1 of Year 1 , bond issuance. 2. july 1 of Year 1 , interest payment. 3. December 31 of Year 1 . interest payment. Note: Round amounts in schedule to the nearest whoie dollar. Note Do not round the effective interest rate used in the sehedule. Note: Do not use negative sigrs: megiaired 2. Whe 20 ef Year 1 inueret payiunt 3. Pecriber if of vear t. micinit maynient. Recording Bond Entries and Preparing an Amortization Schedule-Debt Issuance Costs Mitchell ine. Issued 40 of its 6%,51,000 bonds onjanuary 1 of Year t. The bonds pay cash interest semannually eachijuly 1 and December 31 and were issued te yield 7% Debt iseuance conts wer. \$800. The bonds mature in three years on December 31 , and the company uses the effective interest method to amortize bocd discounts and debe issuance costs Required a. Determine the seling price of the bonds, net of debt issuance contsi. b. Prepare an amortization schedule for the first year of the bond term c. Prepare journal entries on the following dates. 1. January 1 of Year 1 , bond issuance. 2. july 1 of Year 1 , interest payment. 3. December 31 of Year 1 . interest payment. Note: Round amounts in schedule to the nearest whoie dollar. Note Do not round the effective interest rate used in the sehedule. Note: Do not use negative sigrs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts