Question: Please solve a,b and c with full steps and instructions followed. Hope this helps. Question 1: Solve manually, handwritten. (25 points) A company is planning

Please solve a,b and c with full steps and instructions followed.

Hope this helps.

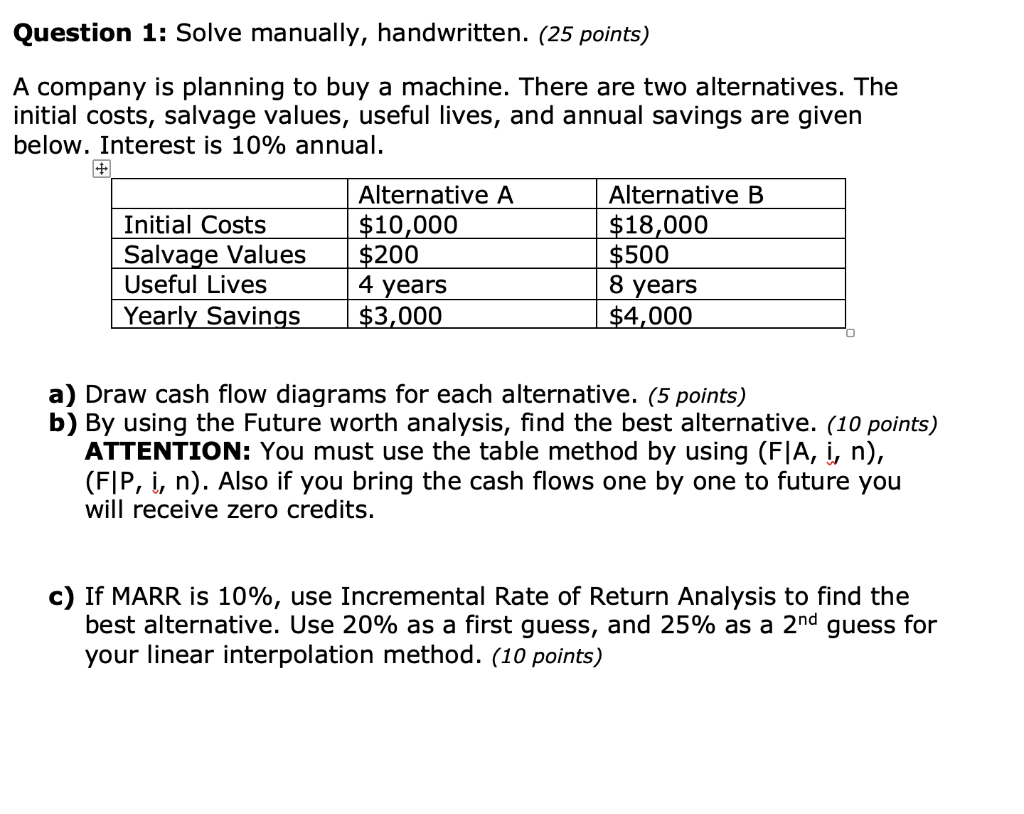

Question 1: Solve manually, handwritten. (25 points) A company is planning to buy a machine. There are two alternatives. The initial costs, salvage values, useful lives, and annual savings are given below. Interest is 10% annual. Initial Costs Salvage Values Useful Lives Yearly Savings Alternative A $10,000 $200 4 years $3,000 Alternative B $18,000 $500 8 years $4,000 a) Draw cash flow diagrams for each alternative. (5 points) b) By using the Future worth analysis, find the best alternative. (10 points) ATTENTION: You must use the table method by using (FIA, i, n), (FIP, i, n). Also if you bring the cash flows one by one to future you will receive zero credits. c) If MARR is 10%, use Incremental Rate of Return Analysis to find the best alternative. Use 20% as a first guess, and 25% as a 2nd guess for your linear interpolation method. (10 points) Question 1: Solve manually, handwritten. (25 points) A company is planning to buy a machine. There are two alternatives. The initial costs, salvage values, useful lives, and annual savings are given below. Interest is 10% annual. Initial Costs Salvage Values Useful Lives Yearly Savings Alternative A $10,000 $200 4 years $3,000 Alternative B $18,000 $500 8 years $4,000 a) Draw cash flow diagrams for each alternative. (5 points) b) By using the Future worth analysis, find the best alternative. (10 points) ATTENTION: You must use the table method by using (FIA, i, n), (FIP, i, n). Also if you bring the cash flows one by one to future you will receive zero credits. c) If MARR is 10%, use Incremental Rate of Return Analysis to find the best alternative. Use 20% as a first guess, and 25% as a 2nd guess for your linear interpolation method. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts