Question: PLEASE SOLVE ALL TAKE AS MUCH TIME AS YOU NEED WSJ R10 Darren and Nora are both saving for retirement in 35 years. Darren starts

PLEASE SOLVE ALL TAKE AS MUCH TIME AS YOU NEED

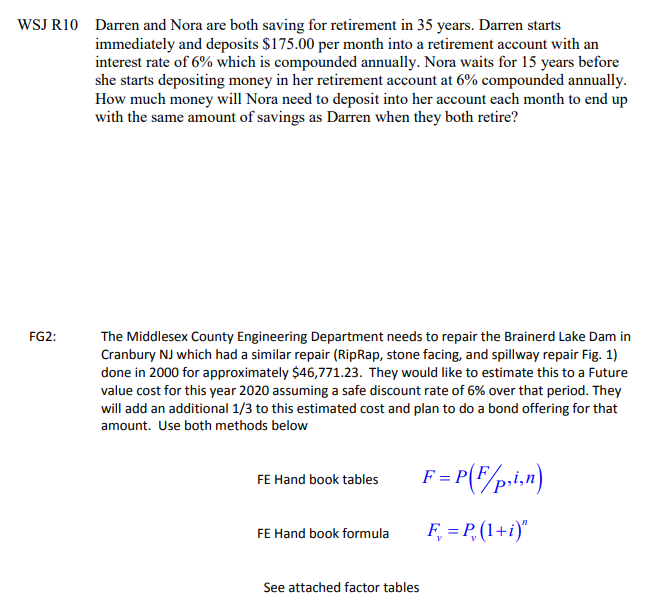

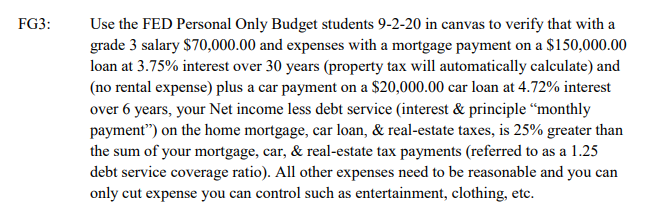

WSJ R10 Darren and Nora are both saving for retirement in 35 years. Darren starts immediately and deposits $175.00 per month into a retirement account with an interest rate of 6% which is compounded annually. Nora waits for 15 years before she starts depositing money in her retirement account at 6% compounded annually. How much money will Nora need to deposit into her account each month to end up with the same amount of savings as Darren when they both retire? FG2: The Middlesex County Engineering Department needs to repair the Brainerd Lake Dam in Cranbury NJ which had a similar repair (RipRap, stone facing, and spillway repair Fig. 1) done in 2000 for approximately $46,771.23. They would like to estimate this to a Future value cost for this year 2020 assuming a safe discount rate of 6% over that period. They will add an additional 1/3 to this estimated cost and plan to do a bond offering for that amount. Use both methods below FE Hand book tables * = P(F/p,i,n) FE Hand book formula F = P, (1+i)" See attached factor tables FG3: Use the FED Personal Only Budget students 9-2-20 in canvas to verify that with a grade 3 salary $70,000.00 and expenses with a mortgage payment on a $150,000.00 loan at 3.75% interest over 30 years (property tax will automatically calculate) and (no rental expense) plus a car payment on a $20,000.00 car loan at 4.72% interest over 6 years, your Net income less debt service interest & principle monthly payment) on the home mortgage, car loan, & real-estate taxes, is 25% greater than the sum of your mortgage, car, & real-estate tax payments (referred to as a 1.25 debt service coverage ratio). All other expenses need to be reasonable and you can only cut expense you can control such as entertainment, clothing, etc. FG4: Alexis has found a car she would like to purchase and she needs to finance $15,000 of the sticker price to buy this car. She can afford no more than $282/month for payments over 5 years. What annual percentage rate (APR) will make it possible for her to afford this car? FG5: Jeancarlos has his eye on the house below. What will be his monthly payments (debt service Interest & Principle) be on a home with a $250,000 mortgage, with an interest rate of 4.10% for a term of 30 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts