Question: please solve all this question as soon as possible, with clear writing ACCUMMI COURSEWORK 1. ISSUED 28 OCTOBER 2020 FOR SUBMISSION BY 12 NOON ON

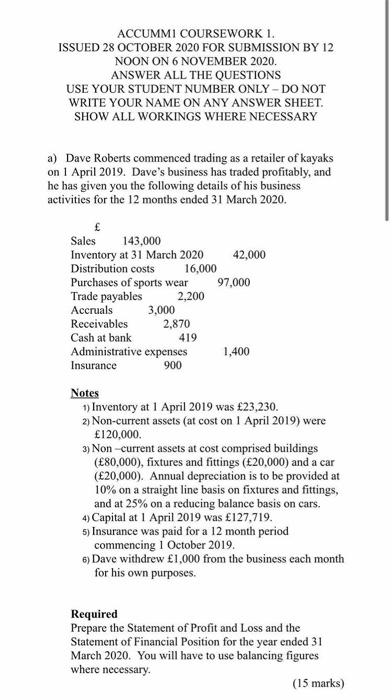

ACCUMMI COURSEWORK 1. ISSUED 28 OCTOBER 2020 FOR SUBMISSION BY 12 NOON ON 6 NOVEMBER 2020. ANSWER ALL THE QUESTIONS USE YOUR STUDENT NUMBER ONLY - DO NOT WRITE YOUR NAME ON ANY ANSWER SHEET. SHOW ALL WORKINGS WHERE NECESSARY a) Dave Roberts commenced trading as a retailer of kayaks on 1 April 2019. Dave's business has traded profitably, and he has given you the following details of his business activities for the 12 months ended 31 March 2020. Sales 143,000 Inventory at 31 March 2020 42,000 Distribution costs 16,000 Purchases of sportswear 97,000 Trade payables 2,200 Accruals 3,000 Receivables 2,870 Cash at bank Administrative expenses 1,400 Insurance 900 419 Notes 1) Inventory at 1 April 2019 was 23,230. 2) Non-current assets (at cost on 1 April 2019) were 120,000 3) Non-current assets at cost comprised buildings (80,000), fixtures and fittings (20,000) and a car (20,000). Annual depreciation is to be provided at 10% on a straight line basis on fixtures and fittings, and at 25% on a reducing balance basis on cars. 4) Capital at 1 April 2019 was 127,719. 5) Insurance was paid for a 12 month period commencing 1 October 2019. 6) Dave withdrew 1,000 from the business each month for his own purposes. Required Prepare the Statement of Profit and Loss and the Statement of Financial Position for the year ended 31 March 2020. You will have to use balancing figures where necessary (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts