Question: Please solve and provide excel formulas Final Prob. 6) The equity and bond markets have become difficult for you to stomach, without a strong antacid.

Please solve and provide excel formulas

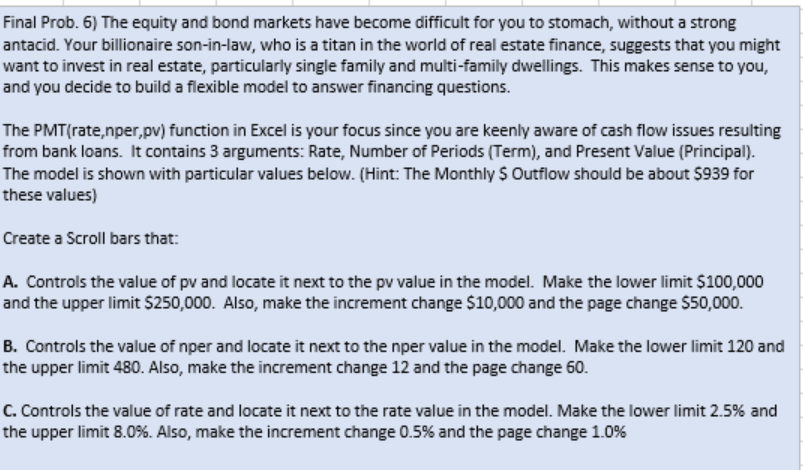

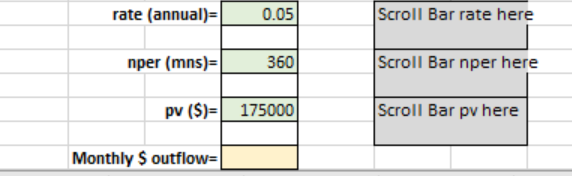

Final Prob. 6) The equity and bond markets have become difficult for you to stomach, without a strong antacid. Your billionaire son-in-law, who is a titan in the world of real estate finance, suggests that you might want to invest in real estate, particularly single family and multi-family dwellings. This makes sense to you, and you decide to build a flexible model to answer financing questions. The PMT(rate, nper,pv) function in Excel is your focus since you are keenly aware of cash flow issues resulting from bank loans. It contains 3 arguments: Rate, Number of Periods (Term), and Present Value (Principal). The model is shown with particular values below. (Hint: The Monthly $ Outflow should be about $939 for these values) Create a Scroll bars that: A. Controls the value of pv and locate it next to the pv value in the model. Make the lower limit $100,000 and the upper limit $250,000. Also, make the increment change $10,000 and the page change $50,000. B. Controls the value of nper and locate it next to the nper value in the model. Make the lower limit 120 and the upper limit 480. Also, make the increment change 12 and the page change 60. C. Controls the value of rate and locate it next to the rate value in the model. Make the lower limit 2.5% and the upper limit 8.0%. Also, make the increment change 0.5% and the page change 1.0% rate (annual) 0.05 Scroll Bar rate here nper (mns) 360 Scroll Barnper here pv ($) 175000 Scroll Bar pv here Monthly Soutflow= Final Prob. 6) The equity and bond markets have become difficult for you to stomach, without a strong antacid. Your billionaire son-in-law, who is a titan in the world of real estate finance, suggests that you might want to invest in real estate, particularly single family and multi-family dwellings. This makes sense to you, and you decide to build a flexible model to answer financing questions. The PMT(rate, nper,pv) function in Excel is your focus since you are keenly aware of cash flow issues resulting from bank loans. It contains 3 arguments: Rate, Number of Periods (Term), and Present Value (Principal). The model is shown with particular values below. (Hint: The Monthly $ Outflow should be about $939 for these values) Create a Scroll bars that: A. Controls the value of pv and locate it next to the pv value in the model. Make the lower limit $100,000 and the upper limit $250,000. Also, make the increment change $10,000 and the page change $50,000. B. Controls the value of nper and locate it next to the nper value in the model. Make the lower limit 120 and the upper limit 480. Also, make the increment change 12 and the page change 60. C. Controls the value of rate and locate it next to the rate value in the model. Make the lower limit 2.5% and the upper limit 8.0%. Also, make the increment change 0.5% and the page change 1.0% rate (annual) 0.05 Scroll Bar rate here nper (mns) 360 Scroll Barnper here pv ($) 175000 Scroll Bar pv here Monthly Soutflow=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts