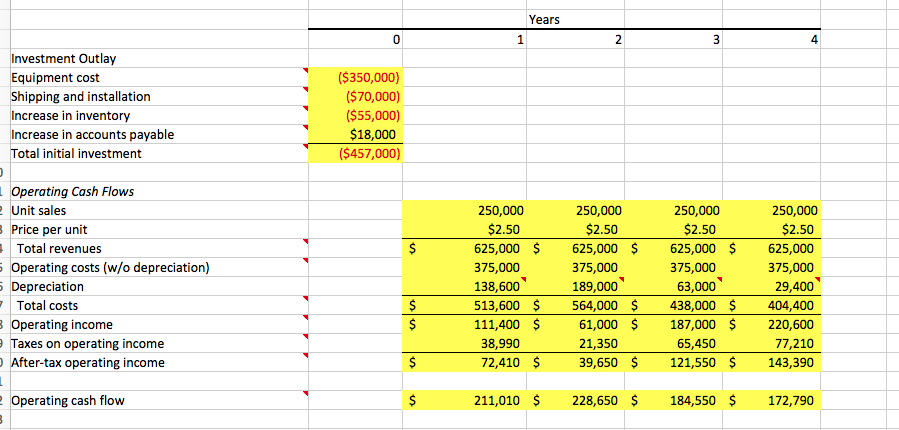

Question: ****Please solve and provide formulas to enter into excel for empty yellow boxes, thank you! Years 0 4 Investment Outlay Equipment cost Shipping and installation

****Please solve and provide formulas to enter into excel for empty yellow boxes, thank you!

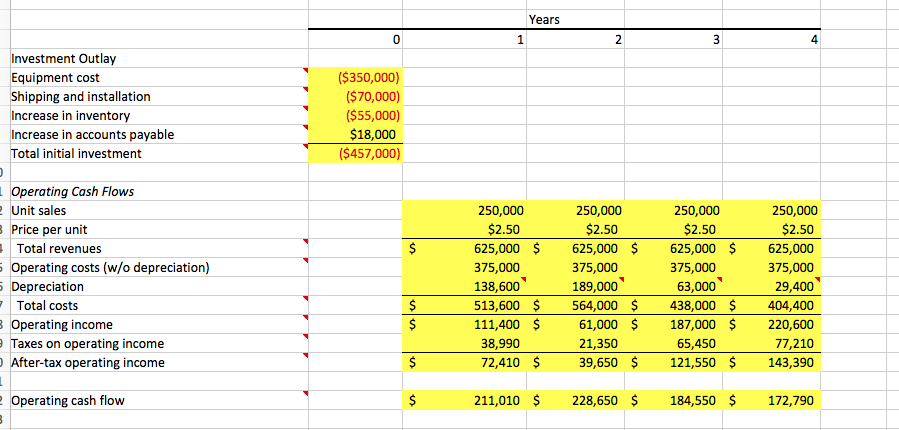

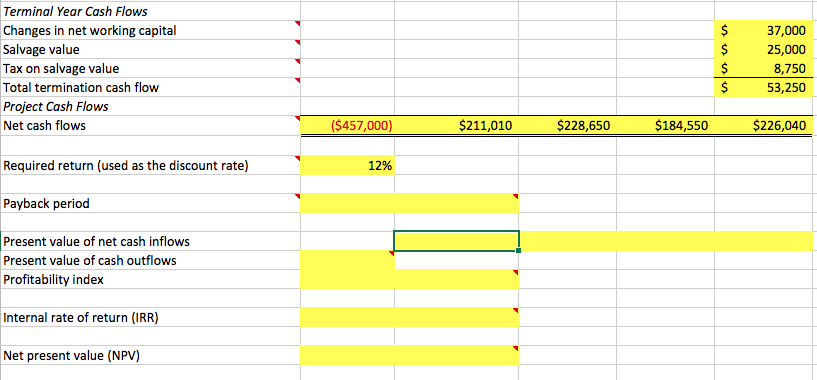

Years 0 4 Investment Outlay Equipment cost Shipping and installation Increase in inventory Increase in accounts payable Total initial investment ($350,000) ($70,000) $55,000) $18,000 ($457,000) Operating Cash Flows Unit sales Price per unit Total revenues Operating costs (w/o depreciation) Depreciation 250,000 250,000 $2.50 250,000 $2.50 250,000 $2.50 625,000 625,000 375,000 138,600 513,600 564,000 $2.50 625,000 625,000 375,000 29,400 438,000 404,400 111,400 61,000 187,000$220,600 77,210 72,410 39,650 121,550 $ 143,390 375,000 189,000 375,000 63,000 Total costs Operating income Taxes on operating income After-tax operating income 38,990 21,350 65,450 211,010 228,650$ 184,550 $ 172,790 perating cash flow Terminal Year Cash Flows Changes in net working capital Salvage value Tax on salvage value Total termination cash flow Project Cash Flows Net cash flows $37,000 $ 25,000 8,750 $53,250 $211,010 $228,650 $184,550 $226,040 Required return (used as the discount rate) 12% Payback period Present value of net cash inflows Present value of cash outflows Profitability index Internal rate of return (IRR) Net present value (NPV) Evoldtion Juice Inc. is Consldering expanding ts existing the Truit jdice buslness. Assume that you were recently hired as assistant to the director of capital budgeting, and you must evaluate the new project. The apple Julce would be produced In an unused bulldlng adjacent to Evolutlon Julce's current plant; Evolution Juice owns the building, which is fully depreciated. The required equipment would cost $350,000, plus an additional $70,000 for shipping and installation. In addition, inventories would rise by $55,000, while accounts payable would go up by $18,000. All of these costs would be incurred today (i.e att-0). By a special ruling, the machinery could be depreciated under the Modified Accelerated Cost Recovery System (MACRS system) as 4-year property. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The project is expected to operate for 4 years, at which time it will be terminated. The cash inflows are assumed to begin 1 year after the project is undertaken, or at t-1, and to continue out to t = 4, At the end of the project's life (t4), the equipment is expected to have a salvage value of $25,000 Unit sales are expected to total 250,000 units per year, and the expected sales price is $2.50 per unit. Cash operating costs for the project (total operating costs less depreciation) are expected to total 60 percent of dollar sales. Evolution Juice's tax rate is 35%, and its weighted average cost of capital is 12%. Tentatively, the apple juice project is assumed to be of equal risk to Evolution Juice's other assets. You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. You are performing the analysis to answer the following questions. Questions 1. What is the payback period of the project? If the cut-off payback period is 2 years, should we accept or reject the project? Why? What is the profitability index of the project? Should the project be accepted? Why? What is the internal rate of return (IRR) of the project? Should the project be accepted? Why? What is the net present value (NPV) of the project? Should the project be accepted? Why? 2. 3. 4. Years 0 4 Investment Outlay Equipment cost Shipping and installation Increase in inventory Increase in accounts payable Total initial investment ($350,000) ($70,000) $55,000) $18,000 ($457,000) Operating Cash Flows Unit sales Price per unit Total revenues Operating costs (w/o depreciation) Depreciation 250,000 250,000 $2.50 250,000 $2.50 250,000 $2.50 625,000 625,000 375,000 138,600 513,600 564,000 $2.50 625,000 625,000 375,000 29,400 438,000 404,400 111,400 61,000 187,000$220,600 77,210 72,410 39,650 121,550 $ 143,390 375,000 189,000 375,000 63,000 Total costs Operating income Taxes on operating income After-tax operating income 38,990 21,350 65,450 211,010 228,650$ 184,550 $ 172,790 perating cash flow Terminal Year Cash Flows Changes in net working capital Salvage value Tax on salvage value Total termination cash flow Project Cash Flows Net cash flows $37,000 $ 25,000 8,750 $53,250 $211,010 $228,650 $184,550 $226,040 Required return (used as the discount rate) 12% Payback period Present value of net cash inflows Present value of cash outflows Profitability index Internal rate of return (IRR) Net present value (NPV) Evoldtion Juice Inc. is Consldering expanding ts existing the Truit jdice buslness. Assume that you were recently hired as assistant to the director of capital budgeting, and you must evaluate the new project. The apple Julce would be produced In an unused bulldlng adjacent to Evolutlon Julce's current plant; Evolution Juice owns the building, which is fully depreciated. The required equipment would cost $350,000, plus an additional $70,000 for shipping and installation. In addition, inventories would rise by $55,000, while accounts payable would go up by $18,000. All of these costs would be incurred today (i.e att-0). By a special ruling, the machinery could be depreciated under the Modified Accelerated Cost Recovery System (MACRS system) as 4-year property. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The project is expected to operate for 4 years, at which time it will be terminated. The cash inflows are assumed to begin 1 year after the project is undertaken, or at t-1, and to continue out to t = 4, At the end of the project's life (t4), the equipment is expected to have a salvage value of $25,000 Unit sales are expected to total 250,000 units per year, and the expected sales price is $2.50 per unit. Cash operating costs for the project (total operating costs less depreciation) are expected to total 60 percent of dollar sales. Evolution Juice's tax rate is 35%, and its weighted average cost of capital is 12%. Tentatively, the apple juice project is assumed to be of equal risk to Evolution Juice's other assets. You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. You are performing the analysis to answer the following questions. Questions 1. What is the payback period of the project? If the cut-off payback period is 2 years, should we accept or reject the project? Why? What is the profitability index of the project? Should the project be accepted? Why? What is the internal rate of return (IRR) of the project? Should the project be accepted? Why? What is the net present value (NPV) of the project? Should the project be accepted? Why? 2. 3. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts