Question: Please solve and show all work. * UUSI y. 15. Banff Limited (a Canadian company) imports die-cast parts from its Taiwanese sub- sidiary that are

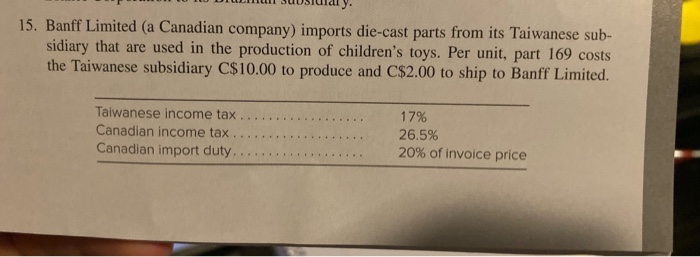

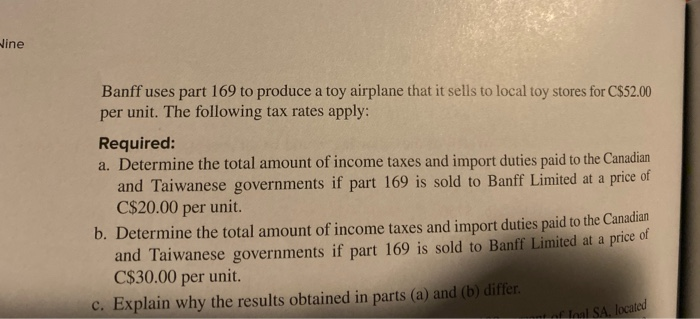

* UUSI y. 15. Banff Limited (a Canadian company) imports die-cast parts from its Taiwanese sub- sidiary that are used in the production of children's toys. Per unit, part 169 costs the Taiwanese subsidiary C$10.00 to produce and C$2.00 to ship to Banff Limited. Taiwanese income tax ..... Canadian income tax .... Canadian import duty..... 17% 26.5% 20% of invoice price Wine Banff uses part 169 to produce a toy airplane that it sells to local toy stores for C$52.00 per unit. The following tax rates apply: Required: a. Determine the total amount of income taxes and import duties paid to the Canadian and Taiwanese governments if part 169 is sold to Banff Limited at a price of C$20.00 per unit. b. Determine the total amount of income taxes and import duties paid to the Canadian and Taiwanese governments if part 169 is sold to Banff Limited at a price or C$30.00 per unit c. Explain why the results obtained in parts (a) and (b) differ. Inal SA, located

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts