Question: please solve as fast you can Work should be done in groups of two or three. Similar submissions will both get a mark of zero.

please solve as fast you can

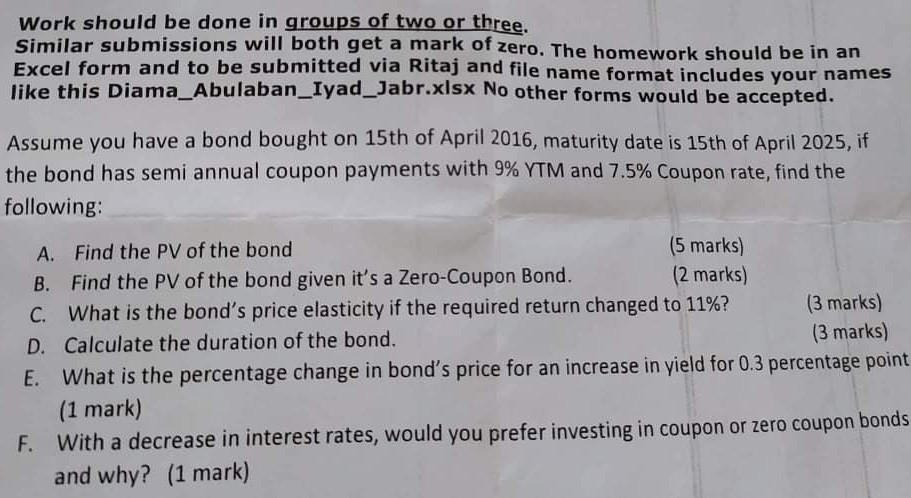

Work should be done in groups of two or three. Similar submissions will both get a mark of zero. The homework should be in an Excel form and to be submitted via Ritaj and file name format includes your names like this Diama_Abulaban_Iyad_Jabr.xlsx No other forms would be accepted. Assume you have a bond bought on 15th of April 2016, maturity date is 15th of April 2025, if the bond has semi annual coupon payments with 9% YTM and 7.5% Coupon rate, find the following: A. Find the PV of the bond (5 marks) B. Find the PV of the bond given it's a Zero-Coupon Bond. (2 marks) C. What is the bond's price elasticity if the required return changed to 11%? (3 marks) D. Calculate the duration of the bond. (3 marks) E. What is the percentage change in bond's price for an increase in yield for 0.3 percentage point (1 mark) F. With a decrease in interest rates, would you prefer investing in coupon or zero coupon bonds and why? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts