Question: Please solve As soon as Solve quickly i get you thumbs up directly Thank's Abdul-Rahim Taysir 19. Portfolio P consists of 2 assets (b and

Please solve As soon as Solve quickly i get you thumbs up directly Thank's Abdul-Rahim Taysir

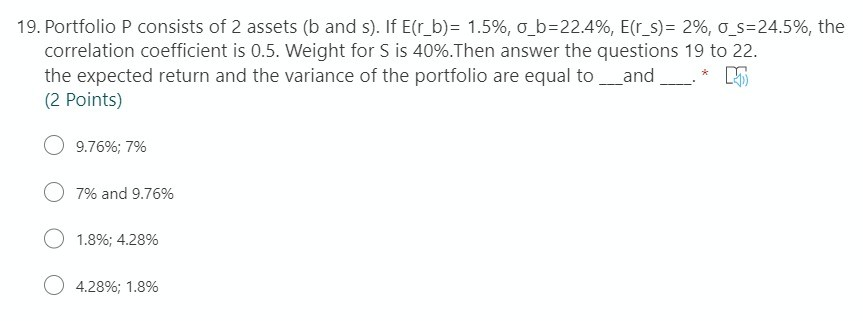

19. Portfolio P consists of 2 assets (b and s). If E(r_b)= 1.5%, o_b=22.4%, E(r_s) = 2%, O_S=24.5%, the correlation coefficient is 0.5. Weight for S is 40%.Then answer the questions 19 to 22. the expected return and the variance of the portfolio are equal to __and (2 points) 9.76%; 7% 7% and 9.76% 1.8%; 4.28% 4.28%; 1.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts