Question: Please solve asap Vimal Enterprises is considering a shipping project for which it proposes to employ a debt-equity ratio of 2:1. Its pre-tax cost of

Please solve asap

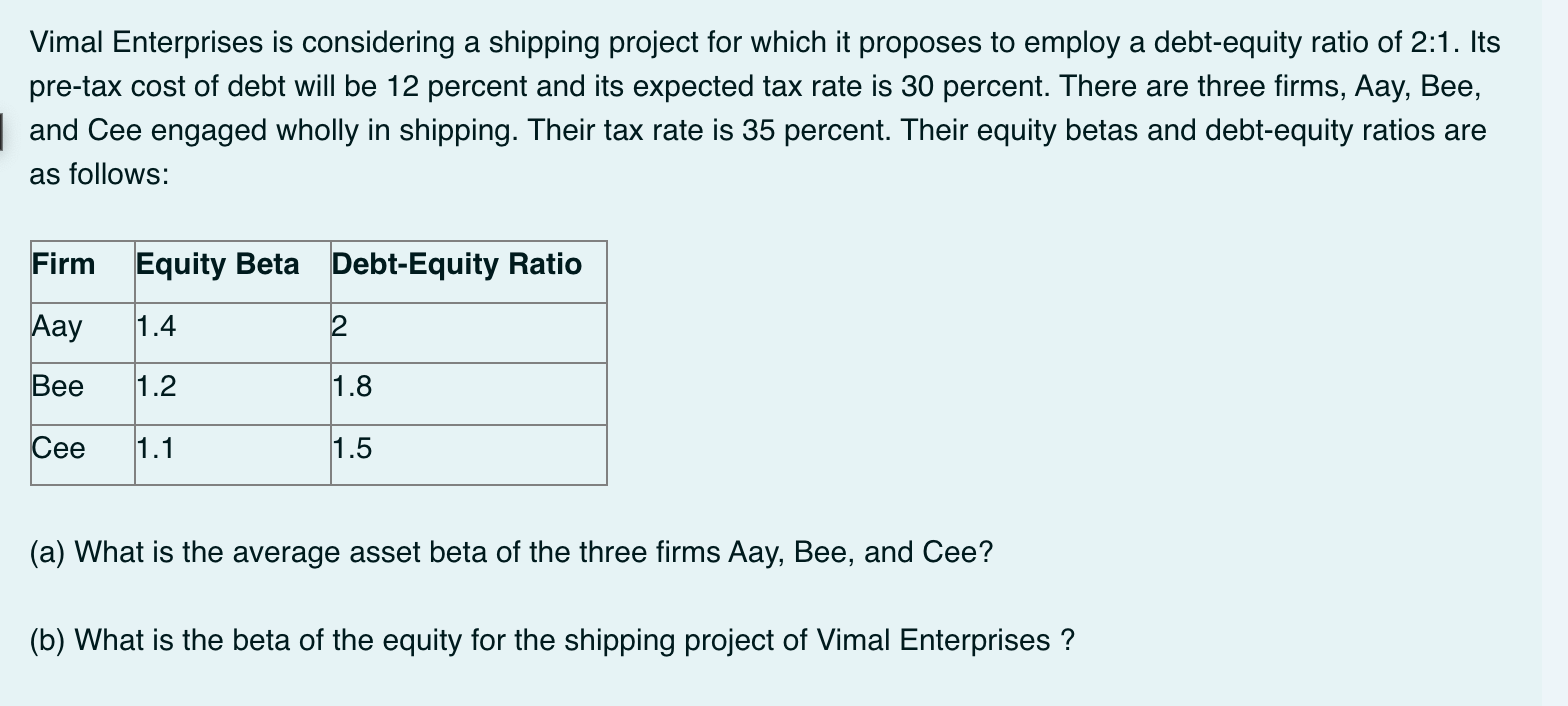

Vimal Enterprises is considering a shipping project for which it proposes to employ a debt-equity ratio of 2:1. Its pre-tax cost of debt will be 12 percent and its expected tax rate is 30 percent. There are three firms, Aay, Bee, and Cee engaged wholly in shipping. Their tax rate is 35 percent. Their equity betas and debt-equity ratios are as follows: Firm Equity Beta Debt-Equity Ratio Aay 1.4 2 Bee 1.2 1.8 Cee 11.1 1.5 (a) What is the average asset beta of the three firms Aay, Bee, and Cee? (b) What is the beta of the equity for the shipping project of Vimal Enterprises

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock