Question: Please solve attached thanks 4. The stock has a beta of 1.6 . The T-bond rate is 6%, and RPM is estimated to be 5%.

Please solve attached thanks

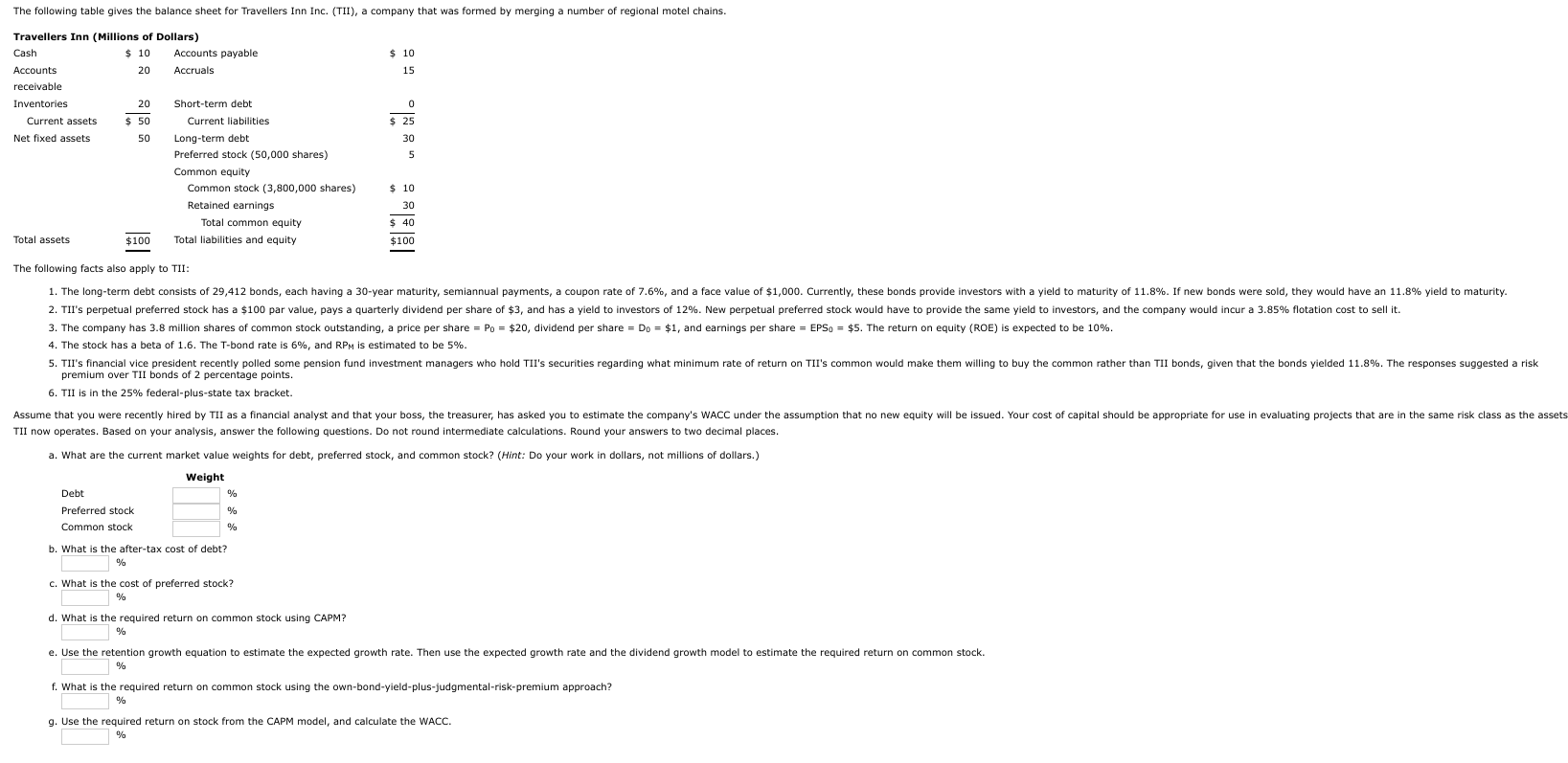

4. The stock has a beta of 1.6 . The T-bond rate is 6%, and RPM is estimated to be 5%. premium over TII bonds of 2 percentage points. 6. TII is in the 25% federal-plus-state tax bracket. TII now operates. Based on your analysis, answer the following questions. Do not round intermediate calculations. Round your answers to two decimal places. a. What are the current market value weights for debt, preferred stock, and common stock? (Hint: Do your work in dollars, not millions of dollars.) b. What is the after-tax cost of debt? c. What is the cost of preferred stock? d. What is the required return on common stock using CAPM? f. What is the required return on common stock using the own-bond-yield-plus-judgmental-risk-premium approach? g. Use the required return on stock from the CAPM model, and calculate the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts