Question: PLEASE SOLVE B UP YEAR 5, A HAS ALREADY BEEN SOLVED * X - More Info __ _ Class Depreciation rate __ 20_ 150% 200%

PLEASE SOLVE B UP YEAR 5, A HAS ALREADY BEEN SOLVED

PLEASE SOLVE B UP YEAR 5, A HAS ALREADY BEEN SOLVED

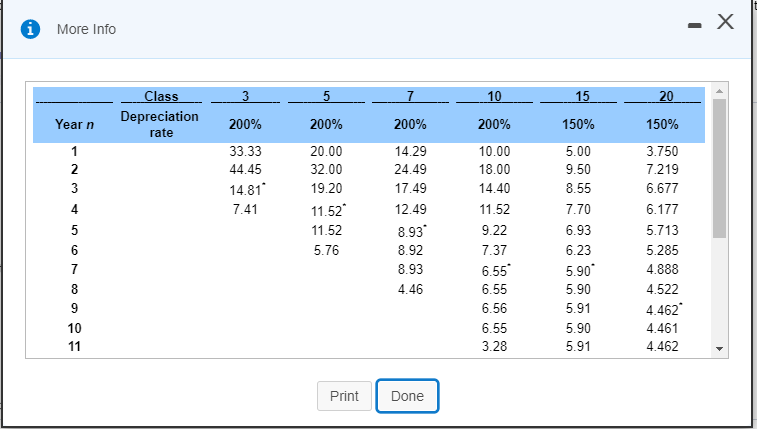

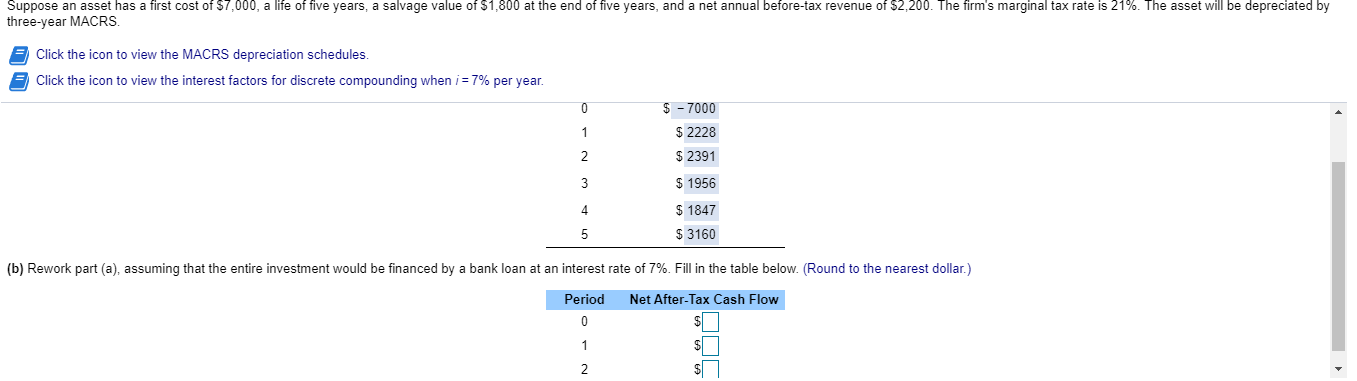

* X - More Info __ _ Class Depreciation rate __ 20_ 150% 200% 200% 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 __10_ 200% 10.00 18.00 14.40 11.52 9.22 200% 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 CooWN- 15__ 50% 5.00 9.50 8.55 7.70 6.93 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 7.37 6.23 6.55 5.90 5.90 6.56 5.91 5.90 5.91 6.55 3.28 4.461 4.462 Print Print Done Suppose an asset has a first cost of $7,000, a life of five years, a salvage value of $1,800 at the end of five years, and a net annual before-tax revenue of $2,200. The firm's marginal tax rate is 21%. The asset will be depreciated by three-year MACRS. Click the icon to view the MACRS depreciation schedules. Click the icon to view the interest factors for discrete compounding when i = 7% per year. $ - 7000 $ 2228 $ 2391 $ 1956 $ 1847 $ 3160 (b) Rework part (a), assuming that the entire investment would be financed by a bank loan at an interest rate of 7%. Fill in the table below. (Round to the nearest dollar.) Period Net After-Tax Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts