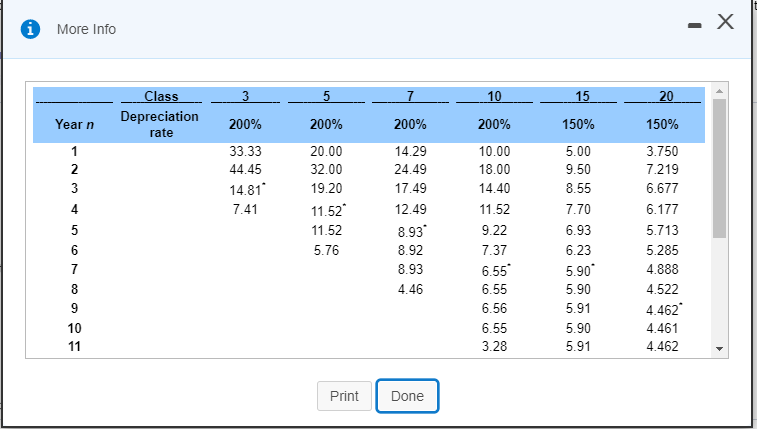

Question: That is all the information given * X - More Info __ _ Class Depreciation rate __ 20_ 150% 200% 200% 33.33 44.45 14.81 7.41

That is all the information given

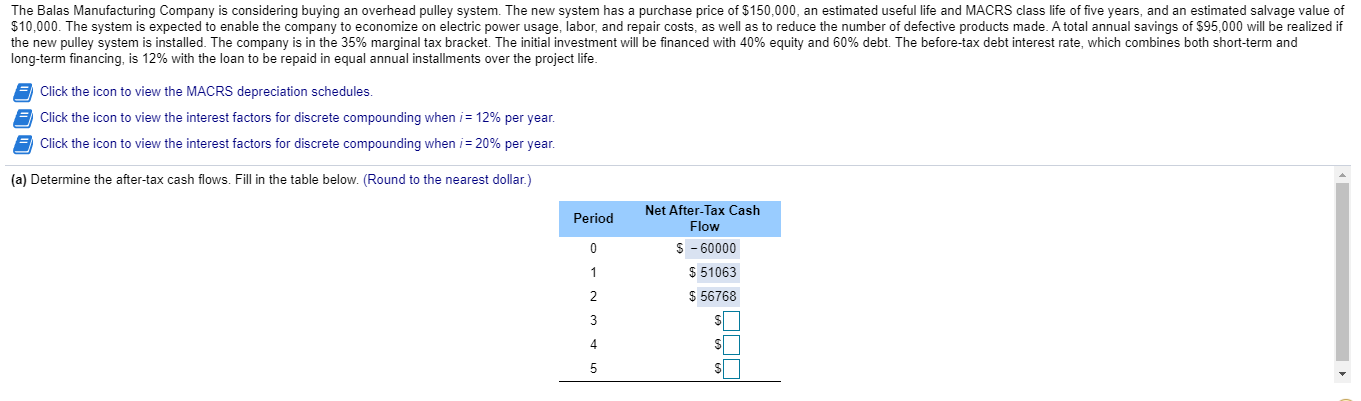

* X - More Info __ _ Class Depreciation rate __ 20_ 150% 200% 200% 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 __10_ 200% 10.00 18.00 14.40 11.52 9.22 200% 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 CooWN- 15__ 50% 5.00 9.50 8.55 7.70 6.93 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 7.37 6.23 6.55 5.90 5.90 6.56 5.91 5.90 5.91 6.55 3.28 4.461 4.462 Print Print Done The Balas Manufacturing Company is considering buying an overhead pulley system. The new system has a purchase price of $150,000, an estimated useful life and MACRS class life of five years, and an estimated salvage value of $10,000. The system is expected to enable the company to economize on electric power usage, labor, and repair costs, as well as to reduce the number of defective products made. A total annual savings of $95,000 will be realized if the new pulley system is installed. The company is in the 35% marginal tax bracket. The initial investment will be financed with 40% equity and 60% debt. The before-tax debt interest rate, which combines both short-term and long-term financing, is 12% with the loan to be repaid in equal annual installments over the project life. - Click the icon to view the MACRS depreciation schedules - - Click the icon to view the interest factors for discrete compounding when i = 12% per year. Click the icon to view the interest factors for discrete compounding when i = 20% per year. (a) Determine the after-tax cash flows. Fill in the table below. (Round to the nearest dollar.) Period Net After-Tax Cash Flow S - 60000 $ 51063 $ 56768

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts