Question: please solve both parts as its the same question 5. As part of this project the firm is considering two mutually exclusive research and development

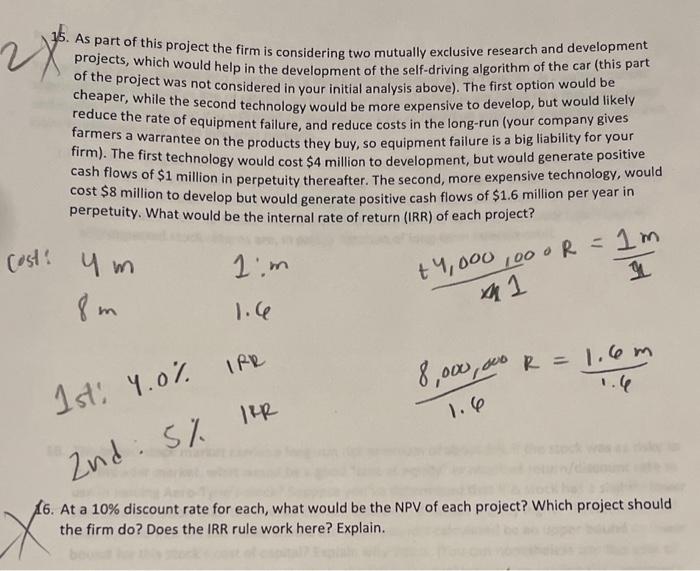

5. As part of this project the firm is considering two mutually exclusive research and development projects, which would help in the development of the self-driving algorithm of the car (this part of the project was not considered in your initial analysis above). The first option would be cheaper, while the second technology would be more expensive to develop, but would likely reduce the rate of equipment failure, and reduce costs in the long-run (your company gives farmers a warrantee on the products they buy, so equipment failure is a big liability for your firm). The first technology would cost $4 million to development, but would generate positive cash flows of $1 million in perpetuity thereafter. The second, more expensive technology, would cost $8 million to develop but would generate positive cash flows of $1.6 million per year in perpetuity. What would be the internal rate of return (IRR) of each project? Isi. 4.0% ifr 1.68,000,000R=1.61.6m 6. At a 10% discount rate for each, what would be the NPV of each project? Which project should the firm do? Does the IRR rule work here? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts