Question: Please solve by using calculator and not all on excel. Confused with how to apply the $40/share. Question 10 0 / 0 pts Citi Group

Please solve by using calculator and not all on excel. Confused with how to apply the $40/share.

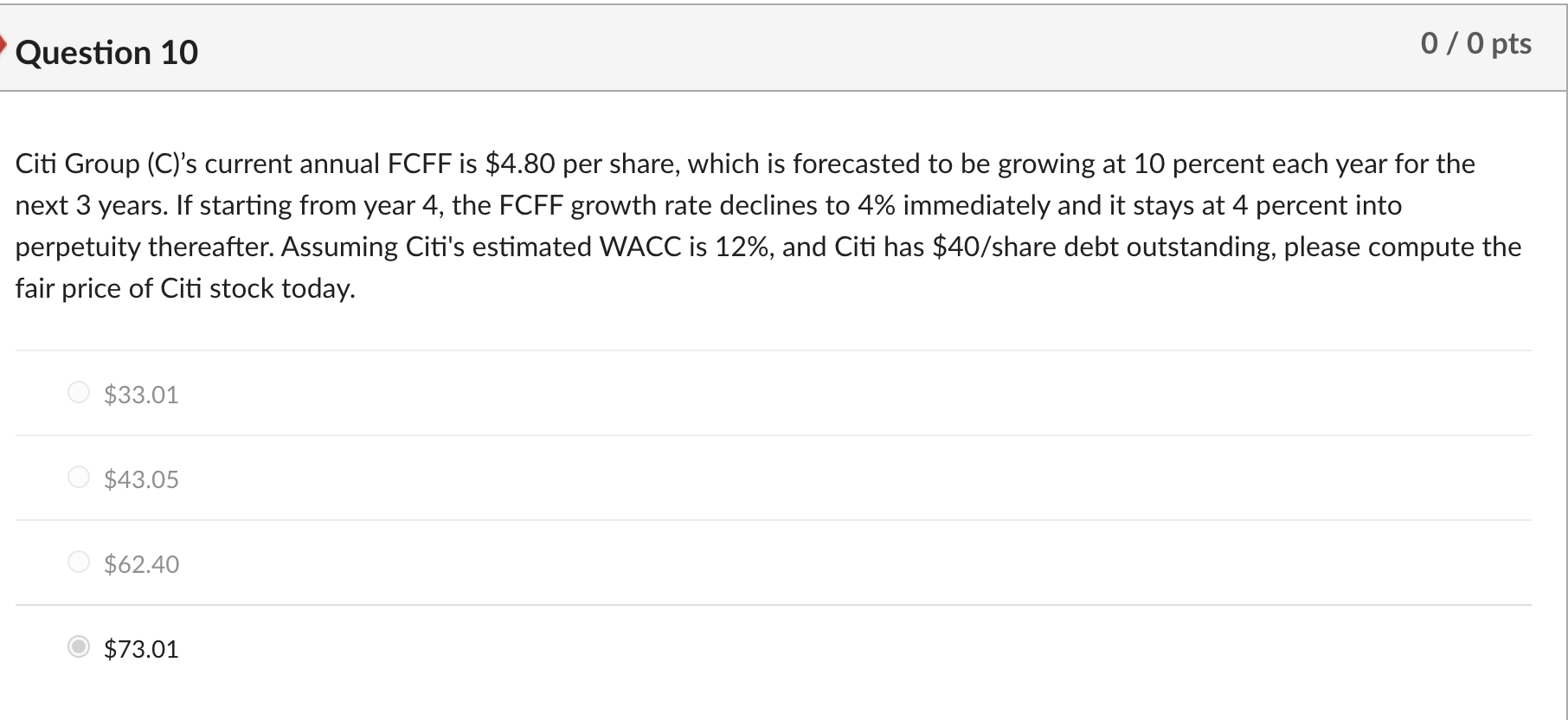

Question 10 0 / 0 pts Citi Group (C)'s current annual FCFF is $4.80 per share, which is forecasted to be growing at 10 percent each year for the next 3 years. If starting from year 4, the FCFF growth rate declines to 4% immediately and it stays at 4 percent into perpetuity thereafter. Assuming Citi's estimated WACC is 12%, and Citi has $40/share debt outstanding, please compute the fair price of Citi stock today. $33.01 0 $43.05 O $62.40 $73.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts