Question: please do it on excel i am struggling with it. Table 92 Forecast Income statement for the U.S. Navy duffel canvas project (dollar values in

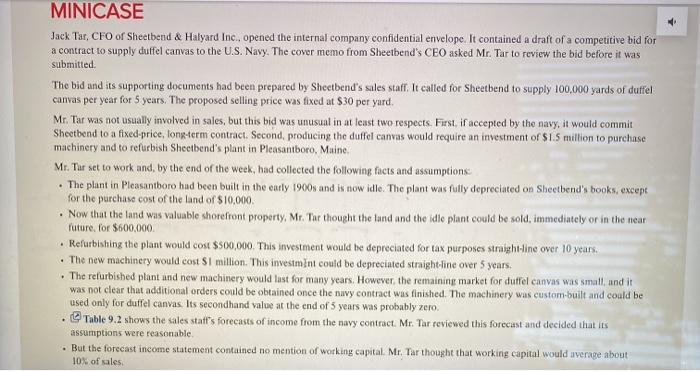

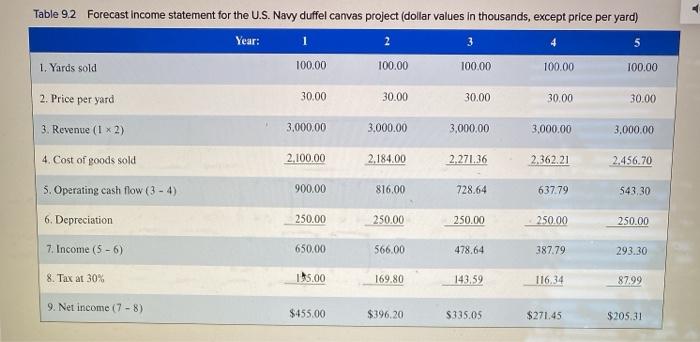

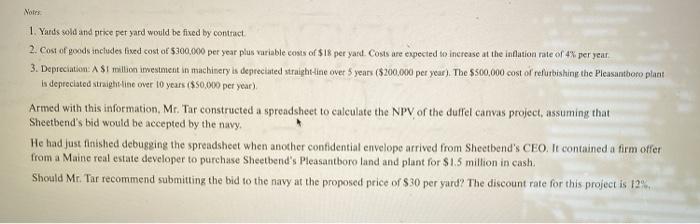

Table 92 Forecast Income statement for the U.S. Navy duffel canvas project (dollar values in thousands, except price per yard) Year: 1. Yards sold 100.00 100.00 1 2 3 5 100.00 100.00 100.00 2. Price per yard 30.00 30.00 30.00 30.00 30.00 3. Revenue (1 x 2) 3,000.00 3.000.00 3,000.00 3,000.00 3,000.00 4. Cost of goods sold 2,100.00 2.184.00 2,271.36 2.362.21 2.456.70 5. Operating cash flow (3 - 4) 900.00 816,00 728.64 637.79 543,30 6. Depreciation 250.00 250.00 250.00 250.00 250.00 7. Income (5-6) 650.00 566.00 478,64 387.79 293.30 8. Tax at 30% 155.00 169.80 143,59 116,34 87.99 9. Net income (7-8) $455.00 $396,20 $335.05 $271.45 $205.31 Notes 1. Yards sold and price per yard would be fixed by contract 2. Cost of goods includes fixed cost of $300,000 per year plus variable costs of $18 per yard. Costs are expected to increase at the inflation rate of 4% per year 3. Depreciation: A $1 million inwestment in machinery is depreciated straight line over 5 years ($200.000 per year). The $500,000 cost of refurbishing the Pleasantboro plant in depreciated straight line over 10 years ($50.000 per year) Armed with this information, Mr. Tar constructed a spreadsheet to calculate the NPV or the duffel canvas project, assuming that Sheetbend's bid would be accepted by the navy, He had just finished debugging the spreadsheet when another confidential envelope arrived from Sheetbend's CEO. It contained a firm offer from a Maine real estate developer to purchase Sheetbend's Pleasantboro land and plant for $1.5 million in cash. Should Mr. Tur recommend submitting the bid to the navy at the proposed price of $30 per yard? The discount rate for this project is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts